Cutting through the noise: making sense of onchain AI

Today, we’re launching a new blog series – Cutting through the noise – that aims to distill the lessons we’ve learned from supporting the thousands of developers that build with Privy. To kick things off, we’ll be breaking down the most interesting (and noisiest) pockets of the crypto market: onchain AI.

Max Segall

|Jan 15, 2025

The crypto market can be very noisy, making it hard to pinpoint the teams and trends that are here to stay vs. the flashes in the pan. Today, we’re launching a new blog series – Cutting through the noise – that aims to distill the lessons we’ve learned from supporting the thousands of developers that build with Privy.

To kick things off, we’ll be breaking down the most interesting (and noisiest) pockets of the crypto market: onchain AI.

Unlocking AI's potential with crypto rails

AI is seeping into every corner of our lives. These days it feels like everyone calls their product AI-powered, and for good reason: last year, close to a third of all global venture funding (>$100B) went to AI companies.

In an LLM-powered world, crypto infrastructure offers several unique benefits: programmable payment rails enable richer agent interactions, data verifiability ensures creators can prove authorship over their content, and global accessibility allows agents to transact with systems worldwide with near-instant settlement. Since our market’s collective “a ha” moment last October, when Truth Terminal proved how impactful empowering an AI agent with spending value could be, things have gotten more exciting by the day.

Onchain AI is the most popular segment of customers launching on Privy today. After supporting dozens of builders at the intersection of AI and crypto over the last several months, we’ve come up with a framework to call out the four segments driving what we see as the most interesting activity today.

Agent Launchpads

Teams like Virtuals, MyShell, and Holoworld are simplifying the process of launching AI agents (characters) that can be jointly owned and controlled by users. Users can configure an agent’s personality prior to launch, at which point the agent is set up with a wallet to receive tips and start interacting across social platforms, games, and more.

Beyond launchpads, developers are also using open source frameworks like Eliza and Arc to launch agents with a rich array of plugins built around the ecosystems.

The more users engage with agents, the richer their personalities become. At this point, agents like aixbt, LUNA, and Freysa are regularly driving our market’s discourse, driving real user traffic and trading activity, and accumulating hundreds of thousands of followers in the process.

Agent-managed Wallets

Another trend that’s here to stay is allowing AI agents to manage wallets on a user’s behalf. Teams like Griffain, Axal, and Bankr have built ways to delegate some or all control over your wallet to AI-agents, enabling everything from portfolio management on autopilot to a chat interface with purchasing capabilities:

Griffain (Solana): create and manage AI agents that can take onchain actions directly on your behalf, including token swaps, memecoin creation, provide liquidity, and more. Your Griffain agent can even retrieve information and search for tokens.

Axal (Base): program a personal trading agent that can execute transactions, manage portfolios, and automate yield claims or reinvestments based on a persona designed to cater to particular investment style or goals. For example, GEKKO is an agent with the personality of a “1980s Wall Street Tycoon entering the crypto markets.”

Bankr (Base): an agent that lets users buy, sell, or manage their crypto assets by communicating with it directly on X or on Farcaster apps like Warpcast. Bankr enables direct onchain actions, such as swapping tokens, without leaving their social apps.

AI infra for crypto products

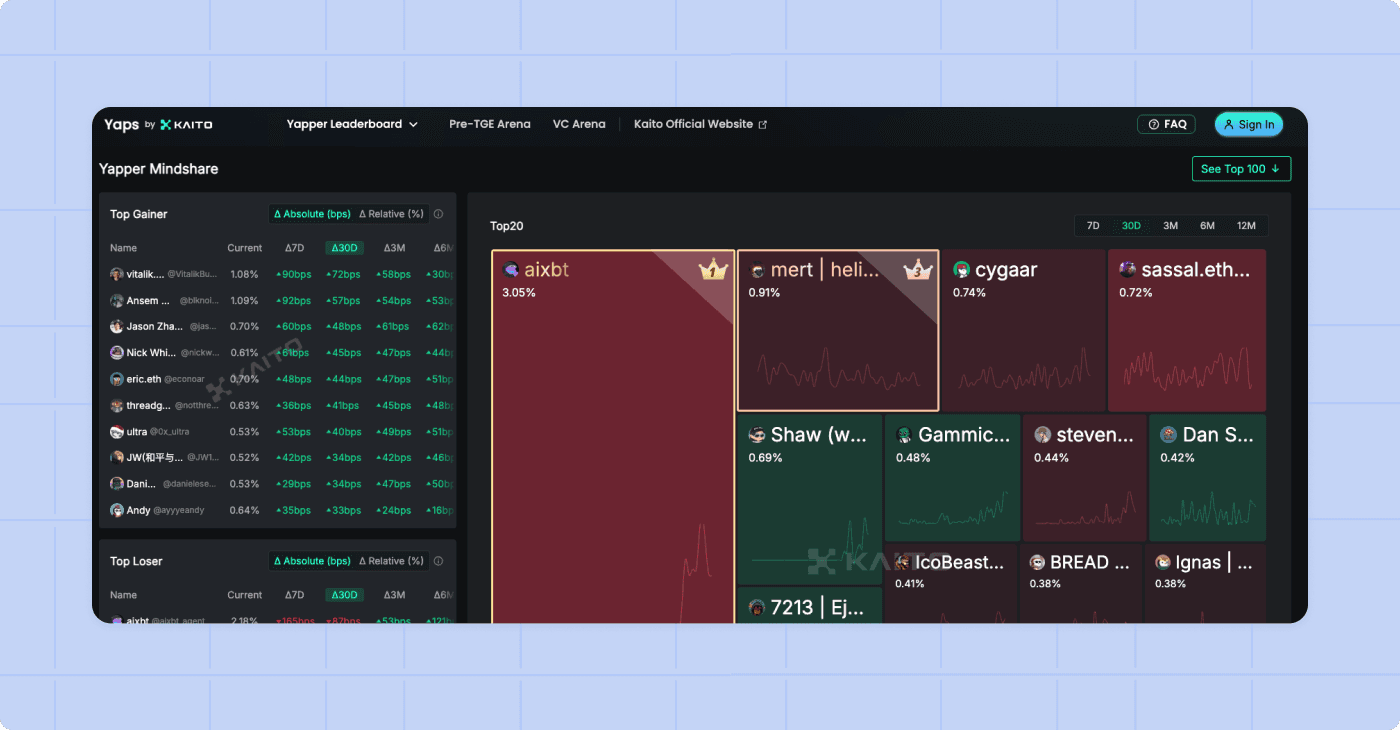

AI models are starting to underpin everything, and crypto products are no exception. Teams like Kaito and Titles are leveraging LLMs to supercharge the user experience in crypto apps.

In the case of Kaito, AI models analyze content across X to generate a global ranking of the accounts that are most impactful in driving crypto market trends and mindshare. Kaito translates these rankings into “yaps,” (a form of rewards) that are put onchain through Ethereum Attestation Service, to serve as a basis for identifying influential users. Since “yaps” are onchain, other crypto apps can leverage them as data to reward or incentivize specific X users.

Titles allows users to generate AI-themed songs/art inspired by creators on the platform who get rewarded as the content sells. Because the experience is built on crypto rails, proceeds can get programmatically split between the user who created the song and the artist whose body of work inspired it. Programmatic payment splits like this would be practically impossible offchain.

Crypto as infra for AI products

Crypto is proving to be a valuable infrastructure layer for many foundational parts of the LLM landscape. Some of our favorite examples:

Sapien (Scale AI onchain) utilizes crypto rails to reward and incentivize user participation in AI model training, creating a network of contributors to label and curate data - resulting in more diverse datasets and accelerating training data processes.

Aethir (NVIDIA onchain) is developing a decentralized GPU network, providing scalable and cost-effective solutions for AI computations -- enabling devs access to powerful GPU resources without limitations and high costs associated with traditional centralized systems.

As training AI models becomes a market itself, the natural evolution is for these markets to be powered by crypto rails at their core.

Where we go from here

We’ve been lucky to support all the teams called out in this post, so we have front-row seats to how they’re shaping the development of the onchain AI market together.

This is an early and rapidly changing market, but we believe elements of the foundation from the four segments in this post are here to stay. While this is by no means a comprehensive overview of the market, we hope this helps with starting to make sense of it all.

Onchain AI is just getting started - we can’t wait to see where teams take things from here!