Beyond Polymarket and Kalshi: 5 prediction markets we are paying attention to

An industry primer on the prediction market ecosystem and where it’s headed

Debbie Soon

|Dec 16, 2025

Prediction markets aren’t new. In fact, versions of outcome-based wagering show up as far back as ancient Greece and the Roman Empire, where people bet on political leadership, athletic competitions, and public events.

At their core, prediction markets turn belief into price. Instead of asking people what they think will happen, they ask what people are willing to stake on an outcome. The outcome is a market-driven signal that changes more regularly and perhaps more honestly than polls or expert predictions.

What’s new isn’t the concept, but the context and the infrastructure. The information world today is more polarized, faster, and louder than ever. People are losing faith in traditional sources of truth. At the same time, more people throughout the world are using financial products, thanks to the always-on internet culture and easier access to financial channels.

That infrastructure makes it possible for prediction markets to operate continuously, globally, and at internet scale. The change has turned an old idea into a real product that is widely available, and where incentives are based on how accurate a belief is, not just what someone wants.

A quick primer: what is a prediction market?

In a prediction market, people bet on what will happen in the future.

There is a clear, time-limited question at the center of each market. For instance, whether a certain event will happen by a certain date (yes or no) or which candidate will win an election (A or B). The market's best guess at the probability of different events is shown by positions that may be purchased and sold, usually for between 0 and 1.

Prices move as new information emerges. When participants believe an outcome is more likely, they buy into it, generating more demand and pushing the price up. When confidence falls, prices drop. Over time, the market price becomes a continuously updating signal that reflects aggregated belief.

What makes prediction markets distinct from polling or forecasting is incentive alignment. Participants are rewarded for accuracy, not expression. People who have greater information, stronger beliefs, or superior judgment are paid to act, while making wrong forecasts costs them money.

Behind the scenes, prediction markets rely on a few core components:

Market creation, which defines the question, outcomes, and timeframe

Liquidity, which allows participants to enter and exit positions efficiently

Resolution mechanisms, which determine how outcomes are verified and settled

Accounts and wallets, which handle funding, positions, and payouts

When these elements work together, prediction markets function as real-time information engines, and translate distributed knowledge into a single, legible signal.

Two leaders, two models: Polymarket and Kalshi

As prediction markets have matured, two platforms have emerged as reference points for how the category can function at scale: Polymarket and Kalshi. While they originated from different starting points, both now sit at the center of an expanding ecosystem of builders, traders, and applications.

Polymarket operates as a crypto-native, permissionless platform. Markets are settled through decentralized mechanisms, with outcomes verified by a distributed set of validators rather than a central operator. This framework lets markets function on open, onchain rails and supports a growing ecosystem of third-party tools, interfaces, and integrations that are developed on top of publicly available APIs and primitives.

Kalshi, by contrast, originated as a centralized, CFTC-regulated exchange based in the United States, with markets created and settled through established regulatory processes. Kalshi has recently started to extend its model onchain by using tokenized prediction markets, starting with Solana. These tokenized markets let outcomes be represented and exchanged as onchain assets. This opens up non-custodial interaction, atomic settlement, and integration with on-chain liquidity and routing infrastructure.

As part of this expansion, Kalshi has introduced Builder Codes, which allow external teams to build applications on top of Kalshi-powered liquidity. These applications span a range of use cases, including trading terminals, analytics dashboards, AI agents, and weather-focused tools. Kalshi has also opened a multi-million dollar grant program to support this ecosystem, with participation currently managed through an application-based process.

Polymarket offers a similar set of primitives through its Builders Program. Polymarket builder codes function as unique credentials that allow developers to enroll in a public leaderboard for volume activity and access the Polymarket Relayer API. Polymarket’s builder tooling is publicly accessible, enabling teams to begin building without an approval process. Like Kalshi, Polymarket also supports builders through a grant program of comparable size.

These programs all point in the same direction for the category as a whole: Prediction markets are becoming more like liquidity layers that outside teams can build on, instead of locked products with just one interface.

Prediction markets we are watching beyond these two

Polymarket and Kalshi are setting the current limits for this category, and the field for constructing prediction markets is growing swiftly.

Some teams are starting from scratch to construct new prediction markets, coming up with their own market structures, ways to resolve disputes, and models for liquidity. Some people are preferring to build on top of existing platforms, using Kalshi- or Polymarket-powered liquidity through builder programs to get new interfaces, workflows, and distribution to market faster.

These methods can all work together. They show diverse trade-offs between speed, control, regulatory stance, and user experience.

Here are some of the prediction markets we are keeping an eye on.

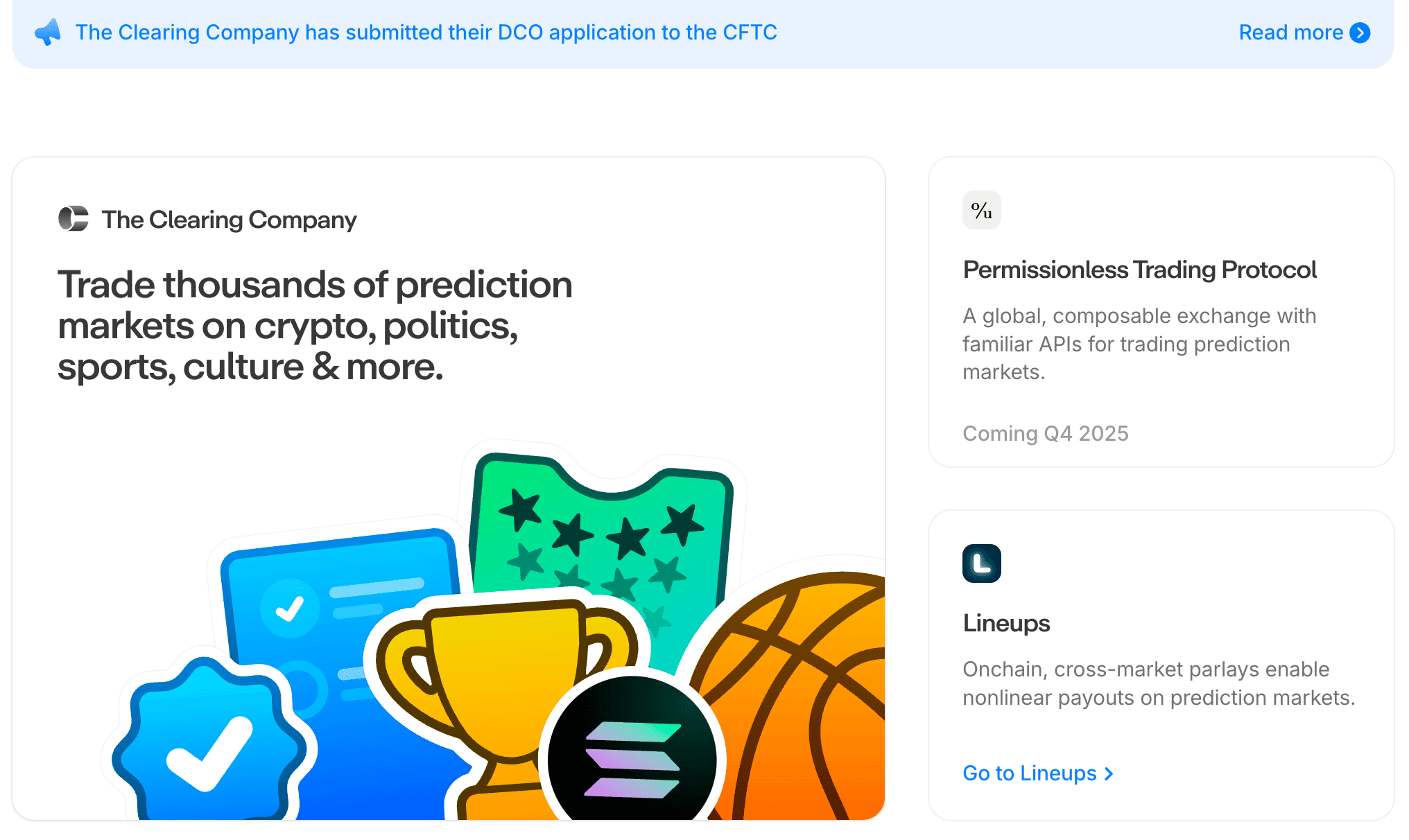

The Clearing Company

The Clearing Company is building a clearinghouse purpose-built for prediction markets and has filed an application with the US CFTC to become a registered Derivatives Clearing Organization (DCO). If approved, it would operate as a stablecoin-native clearinghouse designed specifically for prediction market activity. Rather than adapting legacy derivatives infrastructure, the company is taking a first-principles approach to onchain clearing and settlement while meeting traditional regulatory standards. It recently raised a $15M seed round led by USV and is led on compliance by former Kalshi Chief Compliance Officer Sam Schwartz.

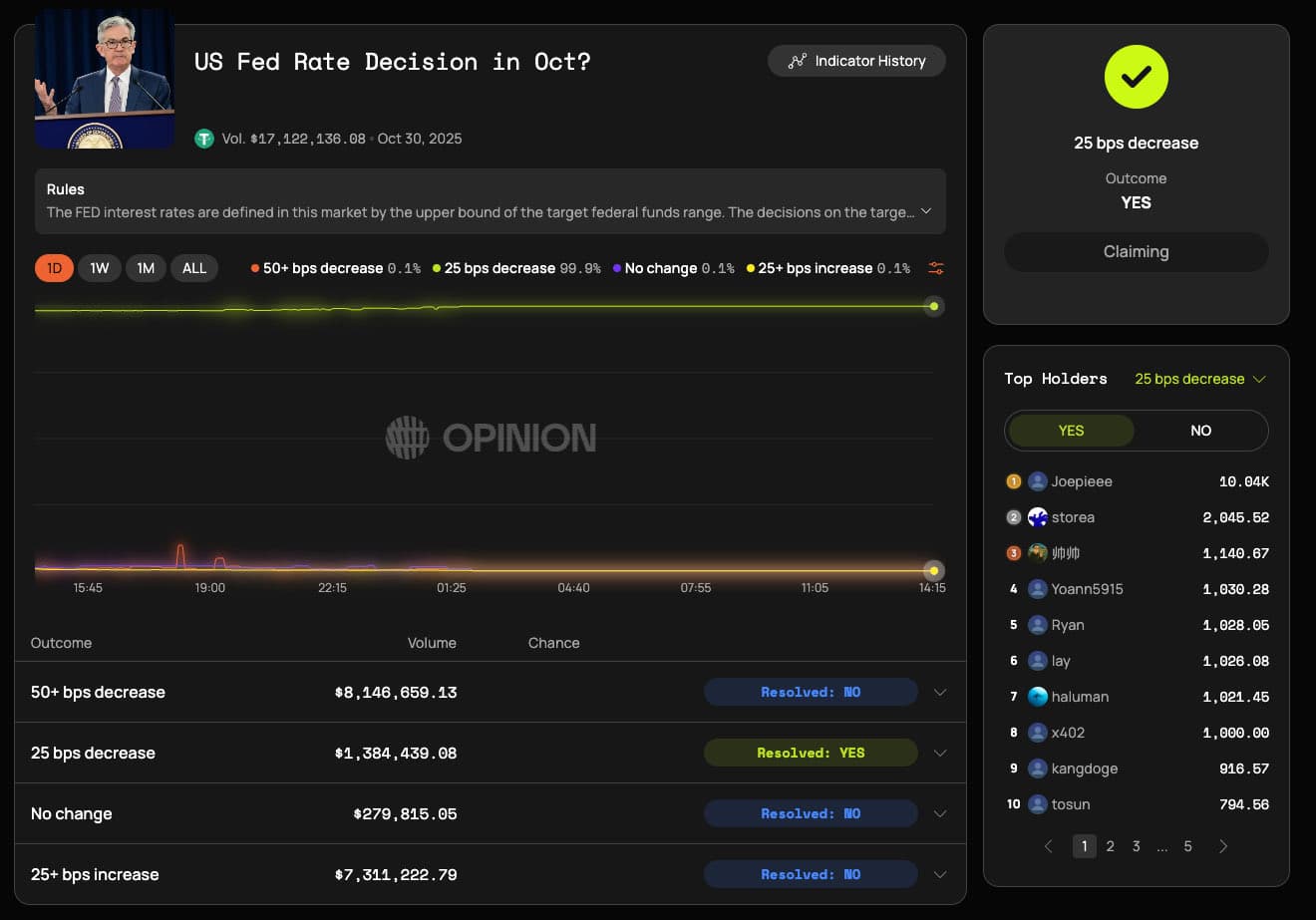

Opinion.trade

Opinion.trade is building a prediction exchange focused on global macro and economic signals. Positioned as a “people’s terminal,” the platform aims to turn economic insights into tradable markets without the cost or access barriers of traditional financial terminals. Its architecture combines onchain trading infrastructure, AI-assisted oracles, and DeFi composability, allowing users to create, trade, and resolve real-world economic markets. Opinion.trade is one of several teams exploring how prediction markets can function as accessible tools for macroeconomic participation.

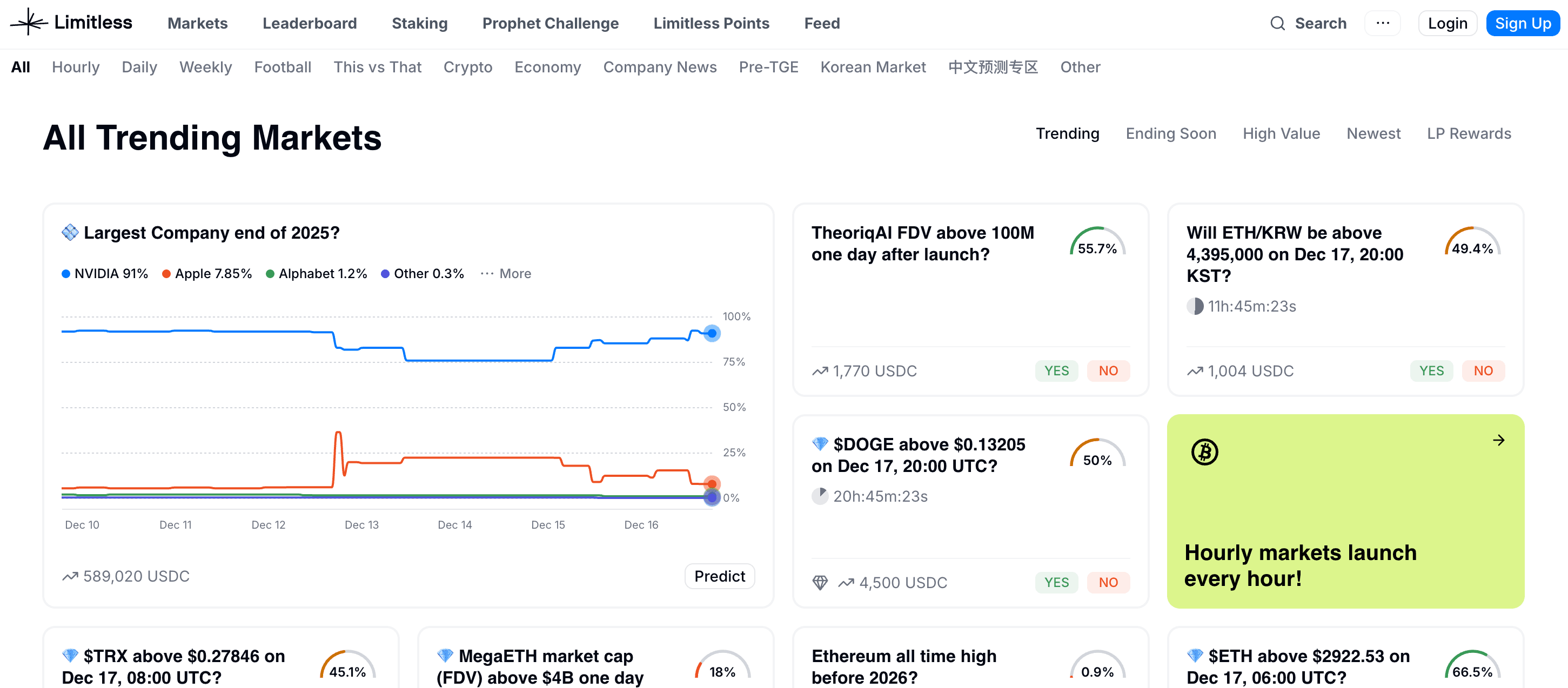

Limitless

Limitless is an onchain prediction market built on Base that allows users to trade natural-language expressions of market conditions across crypto and traditional assets. Markets are typically structured as binary outcomes, with prices reflecting implied probabilities and shares settling at resolution. Limitless emphasizes frequent, short-duration markets, including hourly and daily predictions, and operates using collateralized outcome shares held in smart contracts. With significant trading volume to date, the platform reflects a more trading-oriented approach to prediction markets, optimized for continuous participation and price discovery.

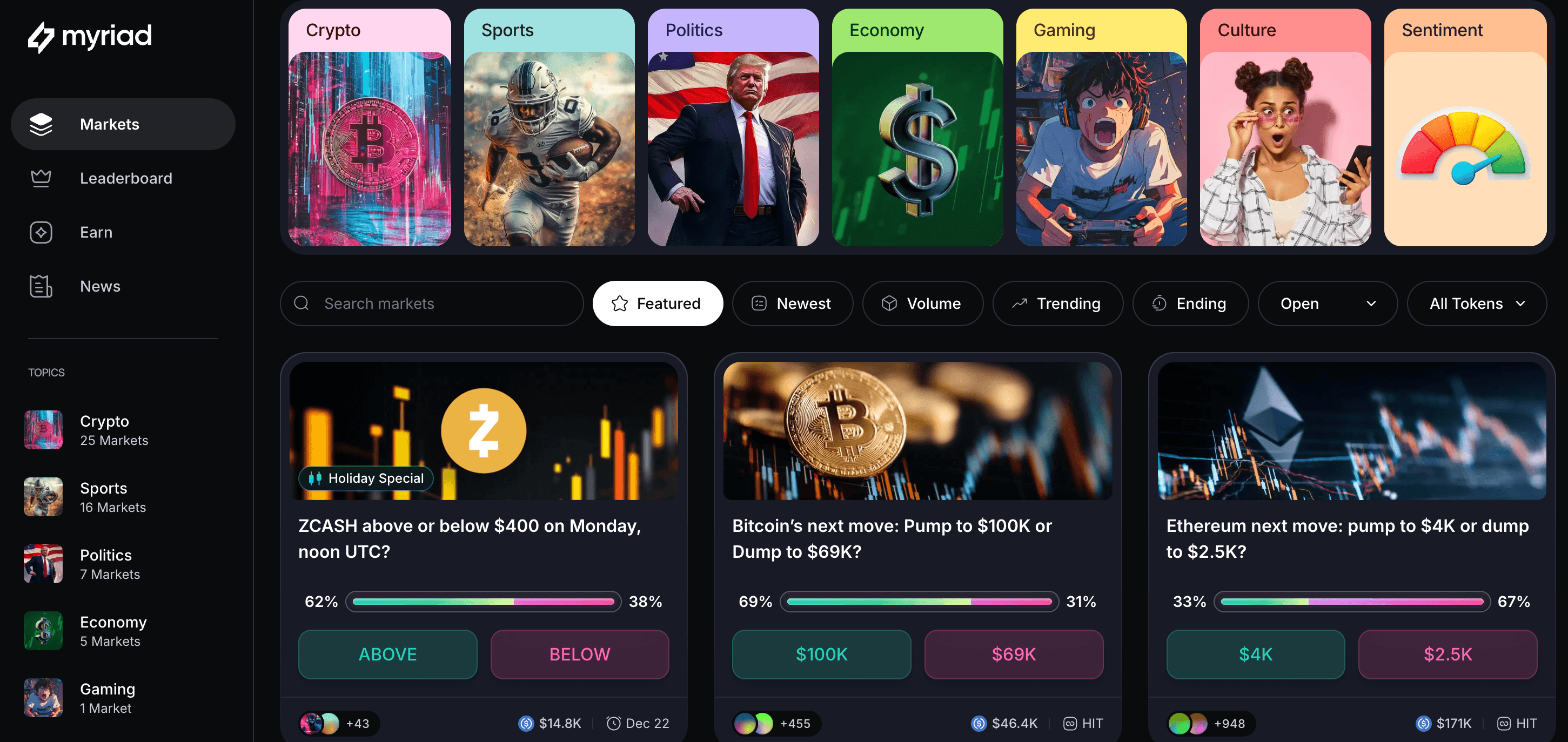

Myriad

Myriad is an onchain prediction market protocol focused on high-volume, social-first participation across multiple chains. Since launch, it has surpassed $100M in USDC trading volume, with millions of trades and hundreds of thousands of active users. Myriad combines automated market structures with a strong media-driven distribution strategy, positioning prediction markets as a social layer for information discovery. The platform is expanding across chains including BNB, Abstract, and Linea, while also positioning itself as underlying infrastructure for other prediction market applications.

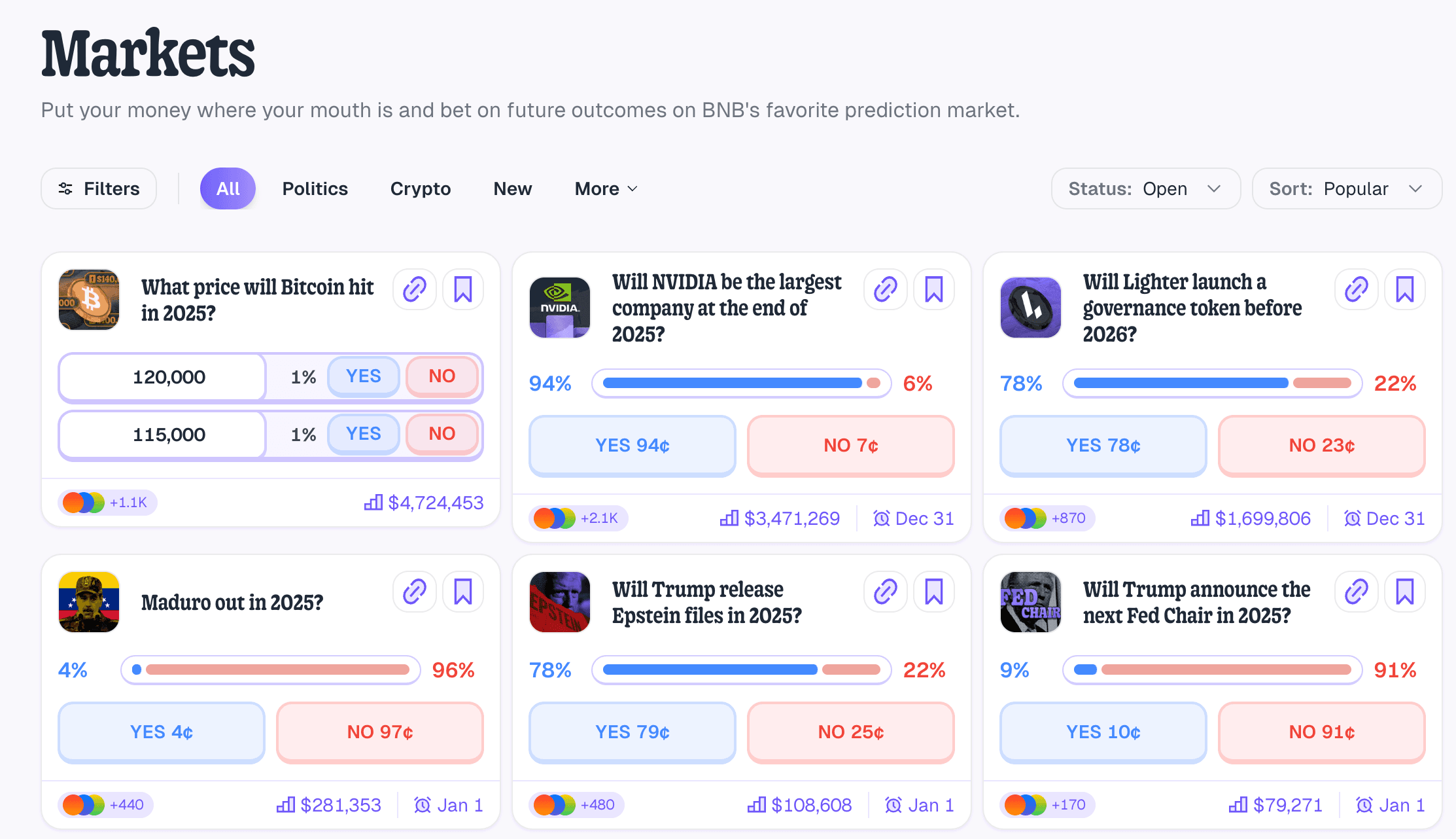

Predict

Predict is a prediction market built on BNB Chain that allows users to trade on future outcomes across categories including politics, crypto, and sports. Markets support both binary and multi-outcome structures, with prices reflecting implied probabilities and settling at expiration. Predict places an emphasis on accessibility and education, walking users through how prediction markets work while supporting more advanced market types like bond-style markets. Outcomes are currently proposed via AI workflows and reviewed internally, reflecting a hybrid approach to market resolution.

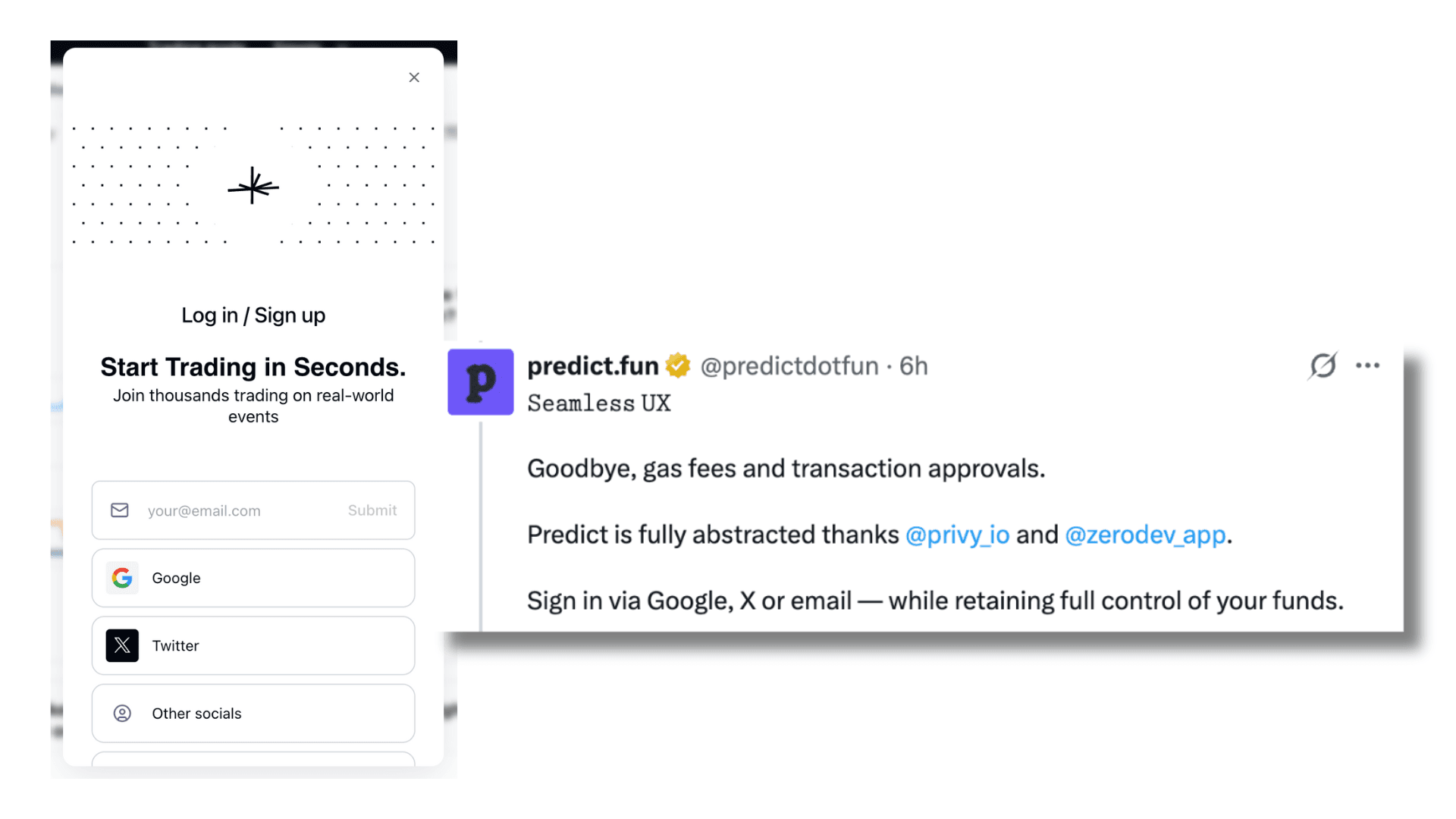

Building prediction markets with Privy

Regardless of market design or regulatory posture, prediction markets still require users to onboard, fund positions, and receive payouts. Wallets are the account layer where collateral lives, trades are executed, and winnings are settled. When that experience is slow, complex, or brittle, adoption stalls.

Privy makes it easy to embed wallets directly into prediction market products, removing friction at the moment it matters most. Wallets can be created instantly at signup using familiar authentication methods, allowing users to move from intent to participation in seconds. Under the hood, Privy is battle-tested and built to operate securely at scale, with programmable policy controls that support everything from consumer-facing markets to regulated, high-volume environments.

Looking ahead

Prediction markets don’t exist because of crypto. They predate it by centuries. What crypto changes isn’t whether they work; it’s how well they work.

By moving settlement, liquidity, and coordination onto programmable rails, prediction markets can become faster, more transparent, and easier to operate at global scale. But those improvements only matter if people can actually use the product. When onboarding is complex or wallets feel intimidating, adoption stalls regardless of how sophisticated the underlying market design is.

That’s where consumer-grade infrastructure comes in. When wallets are embedded, authentication feels familiar, and complexity is abstracted away, teams can build unique experiences on top of existing liquidity provided by platforms like Polymarket and Kalshi, without exposing users to unnecessary friction. Built on crypto rails, but not dependent on crypto-native behavior.

As the category continues to mature, the next phase of growth won’t be driven by novelty or ideology. It will be driven by teams that treat prediction markets as products first, and invest in making participation simple, trustworthy, and universal.