Privy joins Figure’s RWA Consortium on Solana

How real-world assets are moving onchain, and why wallets will shape their future at consumer scale

Debbie Soon

|Dec 4, 2025

Real-world assets (RWAs) have been one of crypto’s biggest promises: real yield from real economic activity. But for most users and builders, the concept has stayed abstract. The infrastructure simply wasn’t ready.

That changes today.

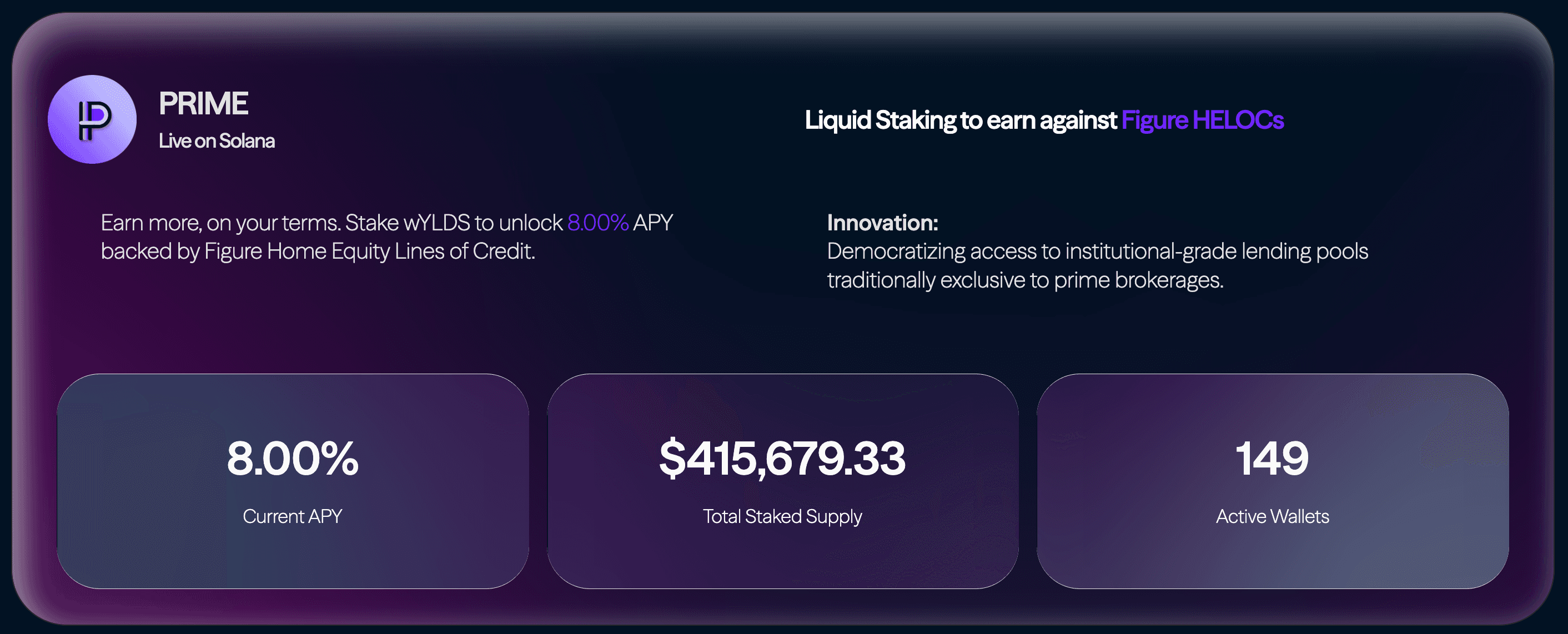

Figure has launched the RWA Consortium, a coalition bringing institutional-grade yield from real lending activity to Solana. At its center is PRIME, a new liquid staking token built on Hastra, a liquidity protocol that connects Figure’s onchain loan markets with decentralized finance. PRIME gives everyday users access to transparent, cash-flow-backed yield generated by Figure’s $1B+ in monthly loan originations.

Privy is excited to join this effort. As part of the consortium, we provide the custodial and self-custodial wallet infrastructure that helps applications onboard users and support PRIME-powered activity across DeFi.

Before diving into our role, it’s worth grounding what RWAs actually are, and why they matter now.

What exactly are RWAs, and why do they matter now?

RWAs are offchain financial assets, like loans, credit, or treasuries, represented onchain. Unlike synthetic yield or staking derivatives, RWA returns come from real borrower payments and real cash flows.

The idea has always been intuitive, but execution has been far more challenging. To scale RWAs, you need compliant origination, trustworthy data, transparent valuation, secure custody, liquid markets, and simple user access all working together.

Those conditions are finally in place. RWAs now have momentum because:

Compliance frameworks for origination and tokenization have matured.

Blockchains offer low cost, fast settlement, and real scalability.

Developers want utility beyond trading, especially yield tied to real economic activity.

Users increasingly seek sustainable returns, not speculative swings.

RWAs matter not just because they live onchain, but because they bring transparency, programmability, and global access to credit markets historically limited to institutions.

Why Figure’s approach is meaningful

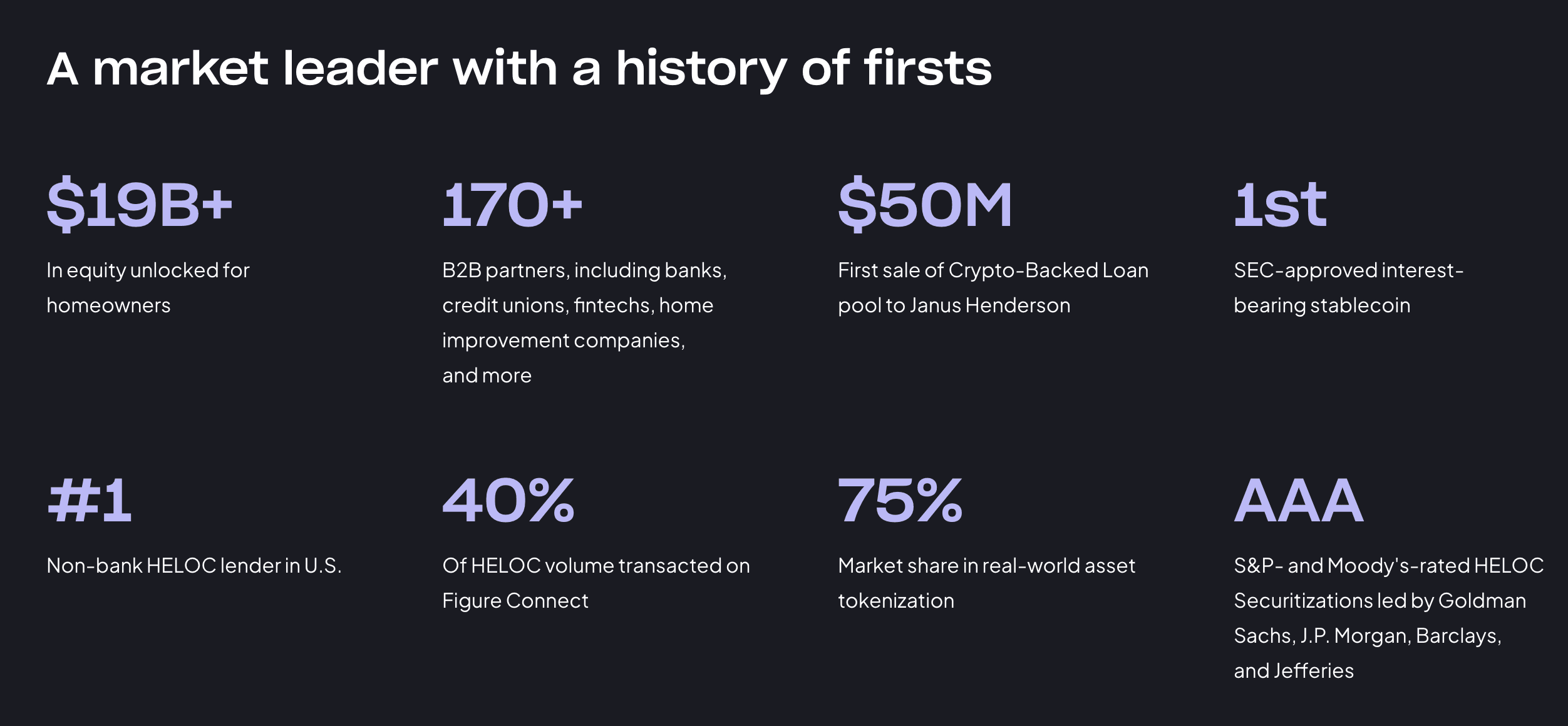

Figure has become one of the largest RWA engines globally:

$19B+ in loan originations

$1B+ monthly onchain origination flow

The first AAA-rated blockchain securitization

A compliant pipeline spanning Home Equity Line of Credit (HELOCs), private credit, and lending markets

Hastra distributes the yield from these loan pools into DeFi, while PRIME packages that yield into a liquid token users can hold, borrow against, and move across chains.

The RWA Consortium brings together the components needed for PRIME to succeed on Solana:

Figure: real-world lending + onchain origination

Kamino: onchain credit and lending markets

Chainlink: oracle integrity + CCIP interoperability

CASH (designed by Phantom and issued by Bridge) → stablecoin liquidity

Raydium: concentrated liquidity + price discovery

Privy: embedded wallet infrastructure for user access

Gauntlet: institutional-grade risk management

It’s one of the first coordinated, full-stack RWA efforts across chains, and a template for how real-world yield will scale.

Privy’s role: the access layer for real-world yield

RWAs only work when users can actually access them. That’s where wallets come in.

To unlock mainstream adoption, RWA-powered apps need onboarding, custody models, security, and liquidity flows that feel as seamless as a neobank. Yet RWAs introduce unique UX and compliance demands behind the scenes.

Privy provides the foundation:

Users can access PRIME-backed products with email, passkeys, OAuth, or their existing wallet; no crypto knowledge required.

Developers can mix custodial and self-custodial flows depending on product, user type, or jurisdiction.

TEE-backed key shares, key sharding, MFA, and built-in recovery protect users interacting with real-world credit assets.

As RWAs grow, wallets become the new global account powering access, portability, and trust. Privy provides that account layer.

A new building block for developers

This announcement isn't just about a new token or yield primitive. It expands what developers can build:

Yield-bearing accounts backed by Figure’s loan payments

Credit products secured by PRIME or other RWA collateral

Payments and remittances powered by cash-flow-generating assets

Agent-driven strategies allocating into RWA markets

Cross-border financial apps with sustainable yield built in

RWAs are shifting from experiment to infrastructure, becoming a core primitive for the next wave of fintech, DeFi, and consumer products.

Privy is committed to supporting builders as this stack matures.

A step toward a multichain RWA future

The RWA Consortium marks the beginning of a multichain RWA future. Each chain offers different strengths, and wallets act as the connective tissue that lets users move, borrow, and earn across them.

As developers bring real-world yield into their products, we’re excited to support them with secure, flexible, production-ready wallet infrastructure.

The future of RWAs won’t be defined by a single protocol or platform. It will be defined by access, and access starts with the wallet.

If you’re building with RWAs, we’d love to talk. Privy makes it simple to onboard users, secure assets, and unlock new financial primitives powered by real-world cash flows.

Learn more about the newly formed RWA consortium here.