How Kulipa powers stablecoin cards with Privy

How Kulipa leverages card networks and Privy wallet infrastructure to give stablecoin assets real-world value

Debbie Soon

|Jul 18, 2025

Kulipa empowers wallets and fintechs to launch stablecoin-backed payment products, starting with debit cards that turn crypto balances into real-world spending power.

Designed as the full payment stack, Kulipa transforms any wallet into a neobank - starting with cards. Developers get everything they need to offer a world-class card experience out of the box: global issuing, compliance, authorization, settlement, and card program management. That means no licensing headaches or operational overhead, and letting teams stay focused on growing their user base.

To power its card infrastructure, Kulipa uses Privy to manage dedicated onchain wallets for each user’s card balance. When a user tops up, funds move from their primary wallet into a Privy-powered card wallet. This ensures secure custody, real-time availability for authorization, and a smooth path to settlement. This setup also lets Kulipa abstract away wallet complexity while maintaining control over the flow of funds across the stack.

“Privy is really the infrastructure component we needed to develop the perfect card product - secure, scalable, affordable, and fast to market.”

— Axel Cateland, CEO of Kulipa

The challenge: making stablecoin spendable

Stablecoin rails combine the reliability of traditional money with the speed and programmability of blockchain networks. For users, they offer easier access to dollars. For builders, they provide a faster, more cost-efficient way to launch financial services globally without relying on traditional banking infrastructure. But while moving money as stablecoin is seamless, spending those balances in the real world remains a challenge.

One of the biggest bottlenecks in stablecoin-powered products today is that most merchants still can’t accept stablecoin payments directly. This makes reliable offramps essential, yet access to local banking partners, liquidity, and regulatory clarity can vary widely across markets. Until stablecoin is accepted natively at the point of sale, users need a seamless way to convert onchain value into local currency when they spend.

That’s where direct card issuance comes in. By linking stablecoin wallets to Visa or Mastercard rails, providers like Kulipa make stablecoin assets spendable without relying on traditional fiat offramps, turning a balance into something users can easily access and spend.

How Kulipa solves this with Privy under the hood

For most apps, launching a card product means stitching together a stack of disconnected systems. This includes wallet infrastructure, compliance controls, transaction authorization, settlement logic, issuer integrations, and more. Funds need to be securely held, instantly verifiable, and traceable across the full lifecycle of a transaction.

This overhead slows time to market and pulls engineering attention away from core product development.

Kulipa abstracts this complexity by providing an end-to-end payment stack, and relies on Privy to provide the wallet infrastructure that secures every transaction.

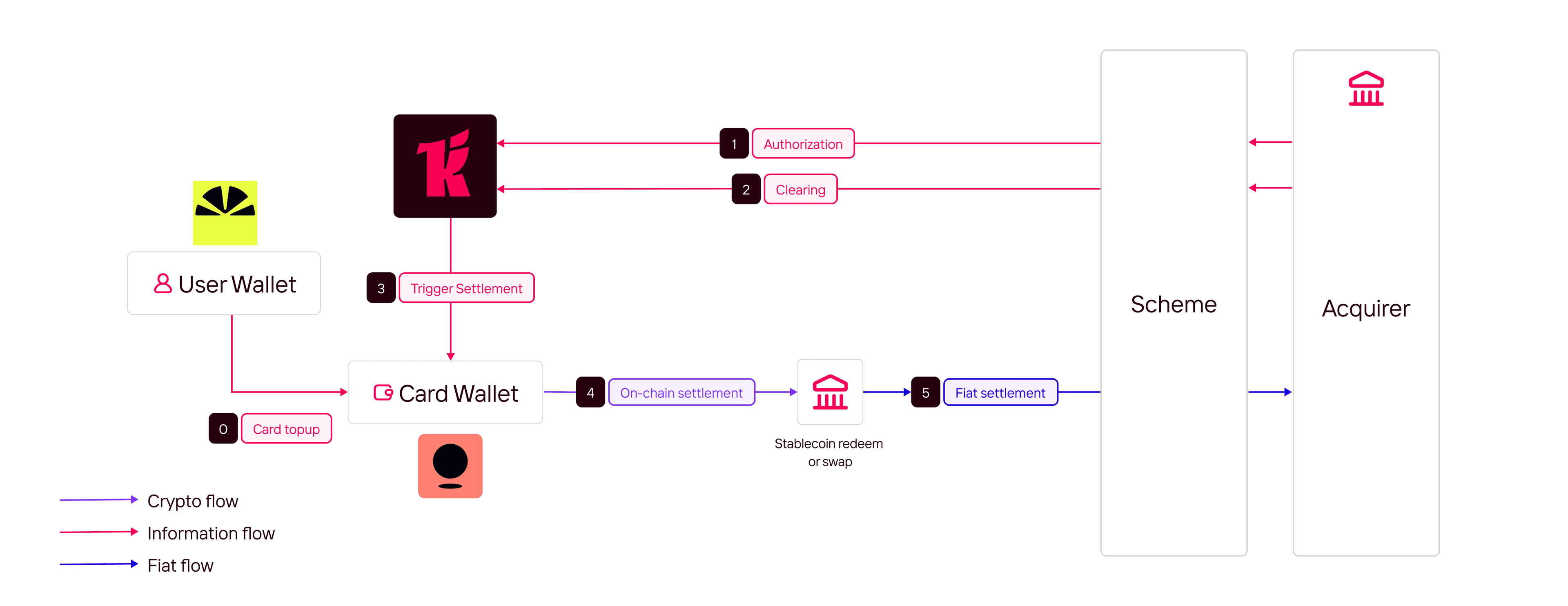

Here’s how the flow works:

Top-Up: The user initiates a top-up, moving stablecoin tokens from their primary wallet (typically managed by the app) into a dedicated Privy-powered card wallet.

Authorization: When a transaction is initiated, Kulipa authorizes the payment in real time by verifying funds availability in the Privy wallet.

Clearing: Kulipa clears the transaction between the card scheme (e.g., Visa/Mastercard) and the acquirer, while funds remain safely locked onchain.

Onchain Settlement: Kulipa settles the transaction by redeeming or swapping the funds from the Privy card wallet. Because the wallets are segregated and verifiable, the flow is both secure and auditable.

This design allows Kulipa to decouple wallet logic from card rails, making it easy for any app to integrate a card flow without building its own wallet infrastructure.

Kulipa chose Privy not just for its developer experience, but for its robust security, high-quality codebase, and ability to scale with confidence. The pricing model also aligned cleanly with Kulipa’s architecture and growth strategy, making Privy a clear fit for launch and beyond.

Going live with MassMoney

Kulipa’s infrastructure is already going live with its first partner: MassMoney, a mobile DeFi app that helps users access more real-world utility with their crypto.

With MassMoney, users can top up a card using their onchain balance and spend it anywhere major cards are accepted. The wallet-to-card flow runs entirely on Kulipa’s stack, with Privy powering the secure card wallets behind the scenes.

This launch with MassMoney is actively helping Kulipa refine and stress-test the product as it gears up for broader adoption across new apps and regions in the coming months.

What's next for Kulipa

With MassMoney going live, Kulipa is now focused on onboarding a diverse set of customers across sizes and verticals to prove the model at scale. A major priority is global issuance with localized setups, with plans to be fully live worldwide by Q2 next year.

On the product side, Kulipa is expanding from offramps into onramps, launching virtual account infrastructure in Europe and beyond. This will enable users not just to spend crypto, but to move seamlessly between fiat and onchain balances, all from within the same app interface.

As Kulipa continues to evolve and expand its stack, Privy is proud to serve as a secure, scalable infrastructure partner, and to power the wallet layer that connects onchain value to real-world payment rails.

Want to learn more about building on stablecoin rails?

Learn more about how stablecoin rails work as well as about Privy’s stablecoin infrastructure stack.

Reach out to us to learn more about how we can help bring your use case to life.