Getting smart on stables: stablecoins 101

Cutting through the noise: what stablecoins are, why they matter and how they’re being used in 2025

Max Segall

|Feb 11, 2025

Over the last year, stablecoins have become an increasingly popular tool in the fintech arsenal. Be it Remote’s launch of global payroll on stablecoin rails, DolarApp’s rise or Nubank’s USDC rewards to Stripe’s acquisition of Bridge, there is a lot happening.

Like any emerging tech trend, it’s hard to separate the signal from the noise. Hence this series. This series will be published in 4 parts:

Part 1: an intro to stablecoins (this one)

Part 2: tools to leverage stablecoins

Part 3: regulatory outlook

Part 4: Stablecoins in 2025 – where we go from here

At Privy, we’ve worked with hundreds of neobanks and cross-border payment actors to make use of stablecoins. Here’s a quick overview of that work so you can get a primer on stablecoins, the uses cases emerging in 2025, and what’s next. Let’s dive in.

What are Stablecoins?

Stablecoins are digital assets that are designed to maintain a stable value, like the US dollar. The most common stablecoins, like USDC and USDP, are backed by fiat reserves, and are always redeemable 1:1 for fiat dollars. The way they work is simple in theory: any business or individual can go to a stablecoin issuer like Circle, deposit dollars, and receive a digital asset (like USDC) issued on a blockchain in exchange.

Why this matters

Because stablecoins are built on public state (the blockchain), they come with blockchain benefits: near-instant settlement, transaction costs that are often fractions of a penny, and flexible programming (e.g., setting up payments to split and settle across multiple parties).

This makes them ideal for cross-border transactions and holding assets globally. Imagine you are working to move a billion dollars from the US to Ghana. Today you have a few options:

Move the funds from your US bank to your counterparty’s Ghanean bank. This will necessitate a number of middlemen taking counterparty risk to move funds across a complex global network. It is slow and expensive.

You can move pallets of cash to distribute the funds (this is typically reserved for aid organizations and governments). This is slow and dangerous. And expensive.

Stablecoins change this.

While stablecoin efficiencies are easy to understand for this billion dollar transaction, the reality is that emerging fintechs operating globally are the ones who stand to benefit the most from these new rails. By making payments cheaper and simpler globally, stablecoins make new transactions possible: global micropayments or transactions that were economically unjustifiable until now. In so doing, they grow the global economy.

Let’s dive in.

How they work.

Stablecoins, only necessitate a point of entry and egress to move between two places. In our example, this means

Entry: moving from USD to a stablecoin – wiring funds, for instance, to the issuer’s bank account so they can issue stablecoins to you.

Transit: transferring the stablecoin to your counterparty. This is cheap and instantaneous on a blockchain system.

Egress – your counterparty sends the stablecoin to a local provider who transfers Ghanian Cedi into their bank account.

Risk exists with the local issuer at entry (or onramp) and counterparty banking partner at egress (or offramp). We are down to two entities in the transaction, who will settle the transaction in fiat amongst themselves in due course. This makes stablecoins better alternative to existing payment rails like SWIFT, ACH, and card networks for many use cases.

Put another way, stablecoin rails are to the traditional financial system what Starlink is to fiber optics: you just need a dish on the ground in two places to communicate efficiently, rather than having to do major construction to lay pipe in the ground.

How are fintechs using them today?

Today, stablecoins unlock broad benefits for three sets of providers, roughly: remittances products, neobanks, and multinationals. This is how.

Cross-border payments

Stablecoins are already driving hundreds of millions of dollars worth of annual consumer/business savings by providing a cost efficient alternative to SWIFT payments and remittances.

International bank transfers and remittances can cost consumers anywhere between 100-400bps in FX fees. With stablecoins, fintechs convert from fiat to digital assets (this is often free in the US since issuers will subsidize these fees) and send the digital assets to another country where they convert back to local fiat. This will cost on the order of dozens of basis points, saving customers anywhere from 1-3c on the dollar for each transfer. It adds up.

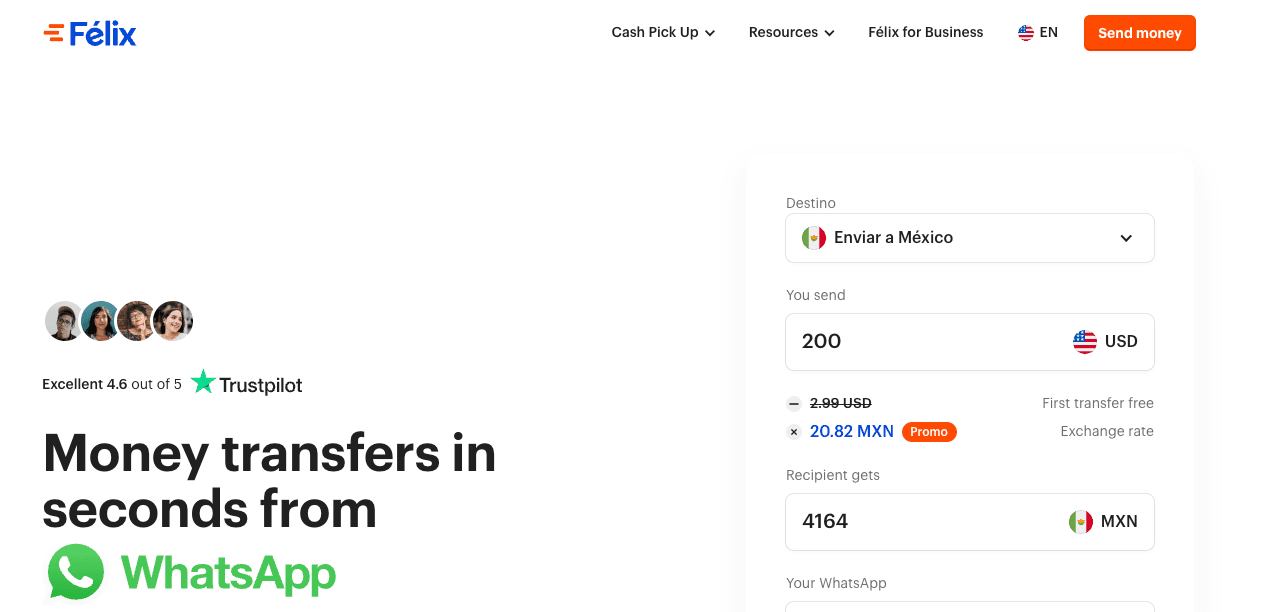

This process can be managed fully behind the scenes on behalf of users. Felix is a great example, already powering single digit percent of the overall US <> Mexico remittance corridor with a stablecoin-enabled payment flow.

Dollar access globally

Stablecoins give anyone around the world the ability to store dollar-denominated assets. This is incredibly valuable in countries with unstable currencies.

Concretely, this means an Argentine contractor for a US company can easily choose to be paid in USDC rather than receiving Argentine Peso. The company has fulfilled its obligation (the payment), but the contractor can hold their savings in a dollar-like asset (backed by real dollars) and spend them down in Peso as needed over time:

Benefits to the company: save on transaction costs, and faster payroll means a gain in capital efficiency.

Benefit to the contractor: save in dollars. No seeing your savings devalued over time.

Benefits to the fintech: cheaper movement, a much longer lived relationship with the contractor who now becomes a customer (until they move the stablecoin back to fiat).

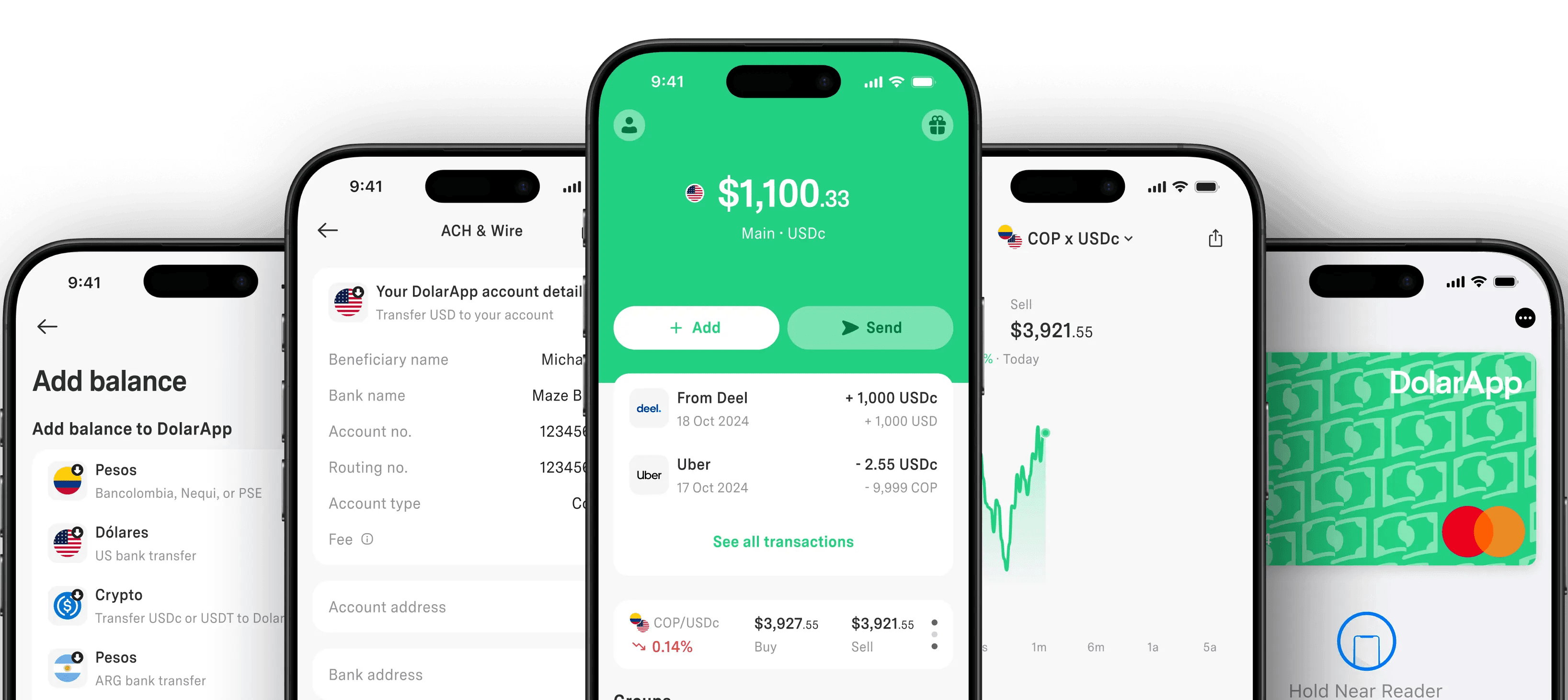

This is exactly what neobanks like Dolar enable: users across LATAM can provide a local account/routing numbers for payroll, and their paychecks get converted to stablecoins on the way into the account. Users interface with the same standard app experience but get the benefit of holding their savings in a more stable currency.

The dollar access benefit is proving to be a way for payroll companies, marketplaces, and other funds-flow businesses to drive user stickiness with recipients in their ecosystems. Instead of value settling with an unattached bank account, marketplaces can disburse stablecoin value to users in a branded wallet (that’s easy to spend within their ecosystem).

Ancillary financial services for global users

Stablecoins are productive financial assets that operate on a global scale. Banks are inherently local and can only offer their customers financial services tied to interest rates dictated by central banks.

Because stablecoins are not inherently tied to a geography (that happens at entry and egress), a holder can choose how their capital is invested worldwide, which makes for a much more open and competitive yield market.

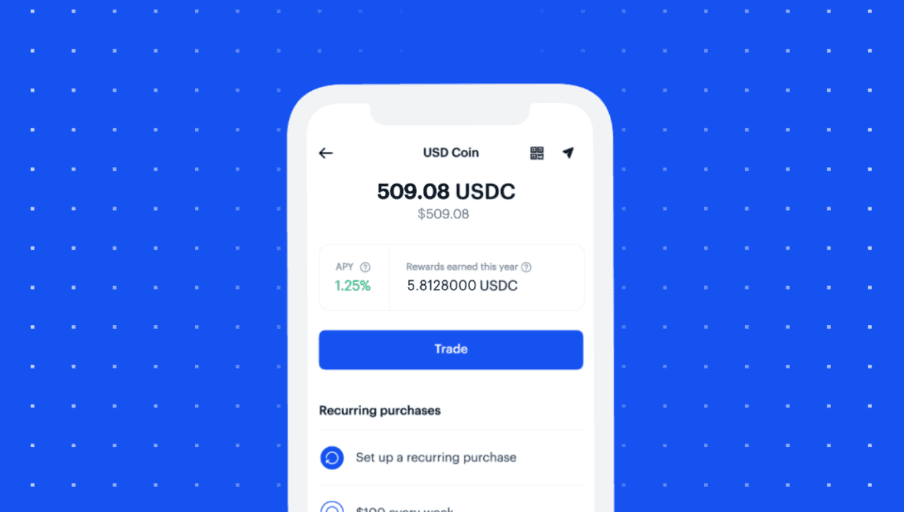

This means higher APRs due to greater capital efficiency and elimination of intermediaries. This is incredibly valuable for fintechs: They become incredibly competitive against incumbents by offering customers better rates.

From there, the fintech can decide whether to pass on these savings to the user or keep some of the spread as revenue.

Global treasury management

Lastly, multinationals and global payment-intensive companies can use stablecoins to manage liquidity.

Concretely this means a faster, cheaper way to repatriate and rebalance funds across markets. This means multinationals can hold fewer reserves abroad, and react more quickly to liquidity needs on the ground leading to greater capital efficiency for their business. Concretely this can represent hundreds of millions of dollars in savings for large multinationals who have historically needed to keep cash reservers across countries to pay suppliers, refund customers, etc.

Broadridge, powering the infra behind many financial markets in the US is using stablecoins as a more efficient way to transfer value between market intermediaries (vs. fiat rails, which are slower and more expensive).

In conclusion

Stablecoin infrastructure has come a long way over the past few years (more on this later) and adoption is booming with over $200B in supply and over $5T transacted over the last 30 days (up 50% over the month prior). Stablecoins are the Starlink to traditional finance’s fiber rails: faster, cheaper, simpler—global. And that’s before we account for the fact that most nations’ financial systems today are closer to coax than fiber (not looking at you Pix).

Next up, we'll dive in on the core building blocks fintechs need to leverage stablecoins in their products. Stay tuned.