Getting smart on stables: What’s in your wallet (stack)?

Building your stablecoin toolkit

Henri Stern

|Mar 5, 2025

A few weeks ago, we wrote how fintechs like Dolar and Deel are using stablecoins to move money more efficiently across borders, enabling users to hold dollar-denominated value globally, and much more.

On the ground, we are seeing a steady acceleration of stablecoin adoption, and beyond that tokenized securities and more.

Like any emerging tech trend, it can be hard to separate the signal from the noise. Hence this guide.

Part 1: an intro to stablecoins

Part 2: tools to leverage stablecoins (this one)

Part 3: regulatory outlook

Part 4: Stablecoins in 2025 – where we go from here

Today, we break down the stack to orient builders looking to leverage these rails to integrate tokenized assets into their products.

Introduction: A map of the cat

We are seeing a sea change in how value flows on the web. Over the past few months, not a day has gone by in which we haven’t talked to a new fintech startup, neobank or remittances company about their stablecoin strategy. Working with these companies to advise them on their build outs, a few patterns emerge.

There is no single way to break down a stack, but here are a few heuristics to help you build the right product on these rails.

Back to the basics

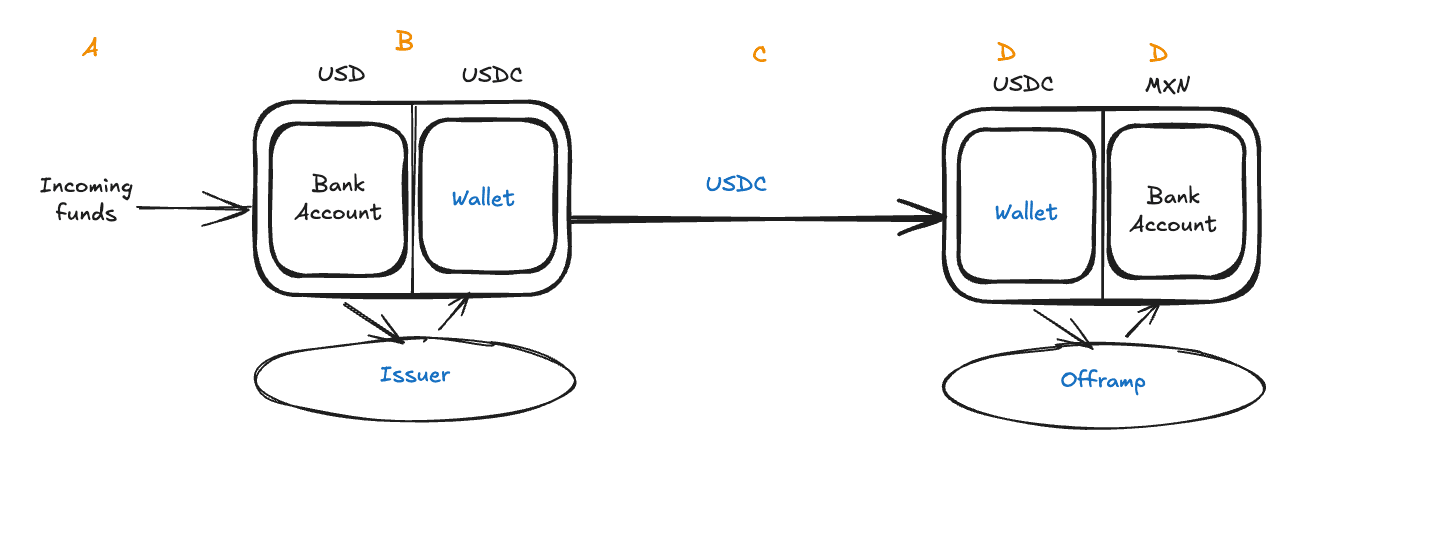

Consider a cross-border remittance company enabling US-based customers to send dollar-denominated value to recipients in Mexico on stablecoin rails. Let’s break it down to isolate components:

At time A, Business A wires funds to an asset issuer (for instance “Circle”, or more often facilitated by orchestration providers that interface with the issuer) in order to get stablecoins (“USDC”) from fiat (“USD”).

At time B, the issuer receives the funds in their bank account and deposits the stablecoins in the sender’s wallet.

At time C, the sender can send the assets to a recipient wallet, received near instantly at time D.

At time E, the recipient can offramp the stablecoin to the recipient currency to be converted back to fiat (in this case MXN) in the appropriate recipient’s bank account.

There are a number of important considerations on offramp choice here related to liquidity in the offramp (can they process your volume), fees, time to offramp, etc. More on that in a second.

Adoption of stablecoins has broadly been unblocked by the emergence of orchestration companies that have made it far easier to leverage these tools as part of integrated end-to-end flows. Bridge is a pioneer here who understood that enabling end-to-end flows so these rails can be used as payments infrastructure is essential to making them usable. Nonetheless, it’s essential to call out a few key components that can be used apart or together to orchestrate the right flow for your product.

The components

In this section, we will break down core components of a stablecoin flow. We are focusing on the minimal component set needed to move funds from A to B. Working with providers at scale, there are further optimizations to be done once you’ve launched to improve capacity, cost, and speed of your rails. As with any product release, our advice is the same: start small and make sure you future proof your stack so you can iterate from launch.

Accordingly, some of the components to consider.

Wallet Infrastructure

This is the one we think a lot about: wallets. At the heart of any stablecoin-enabled financial system is the wallet infrastructure that ensures users can seamlessly receive, send and hold stablecoins.

Wallets can be thought of as crypto bank accounts. Two shapes we commonly see in deployments are omnibus and user-specific wallets. User (or account) specific wallets enable each user to hold their own funds in a dedicated wallet (which they can also custody themselves). Omnibus wallets pool assets together across users, mirroring how many neobanks manage fiat assets. We increasingly see a shift toward user wallets as this separation decreases risk related to colocation of funds, and simplifies asset ledgering as you layer services on top of these wallets.

When selecting a wallet infrastructure partner, here are a few of the key dimensions to consider – Fair warning: some Privy-centric content may find its way below:

Security: Assets held in embedded wallets are secured by private keys that control the wallets, so it's critical to understand how your wallet infra partner secures their wallets’ private keys.

Privy’s architecture and granular policy engine ensure only the appropriate party can ever control the wallet, whether launching user self-custodial wallets or managing your own assets. You can read more here.

Performance: Consider how many users and transactions you’ll need to process for your use case, ask potential wallet infra partners for user volume, dollar volume, and latency stats to evaluate fit.

Privy prides itself on building enterprise-grade security with consumer-grade performance: we’ve provisioned more than 50M embedded wallets, with tens of millions of signatures generated monthly, processing billions of dollars worth of transaction volume with <200ms transaction latency.

Custody: Depending on the experience you are trying to set up, the services you want to provide atop your system and the regulatory requirements of the region you are serving, you may choose to provision self-custodial (or unhosted) wallets for your users or custody assets on their behalf.

Privy enables the provision of user self-custodial wallets tightly coupled to any OIDC-based authentication system, as well as the generation of fleets of wallets directly from your servers. Wallets are only ever accessible by the appropriate party, whether you are managing funds directly or these are user wallets orchestrated in your product.

A note on owning your wallet

Building out dozens of flows with our customers, it becomes clear that wallets are the nexus of control for tokenized assets.

Owning the wallet orchestration for your product (whether custodial or self-custodial) is how you future-proof your stack. You can break this down in a few ways:

Wallets are the account system for tokenized assets. Control over the wallet is control over the assets. Not using your own wallet system disintermediates your relationship with your user.

Wallets future-proof your payments rail setup. Control over chain, supported asset (and the economics associated with that), and on/offramp providers helps future proof your setup. This is a fast moving space and owning your wallet ensures you can compose your system with the best provider(s) for your use case/geography, etc.

Wallets enable you to offer ancillary services on the stablecoin stack. If your user holds digital assets, you can offer a number of ancillary services atop this digital account, from yield to credit and more. Orchestrating the wallet system directly lets you control these interactions.

Payment rails: onramp-chain-offramp

If wallets are the control and account system, the rails are composed of three components:

Onramps (entry): interfacing with issuers or exchanges to move from fiat to stablecoin

The chain (transit): the means through which these assets move to a recipient wallet.

Offramps (egress): local partnerships on the ground enabling the asset-owner to move from stablecoin back to fiat or transact with a stablecoin directly.

Let’s start with the on and offramps. Funds-flow stablecoin businesses can be thought of as foreign exchange (FX) facilitators. They allow fintechs to receive fiat funds from users and convert them into stablecoins (often running KYC/AML checks to ensure compliance). Given how globally the stablecoin value prop resonates, most neobanks will orchestrate several providers to cover their priority geographies, for instance including Bridge or HiFi (US/Europe), Caliza or Conduit Pay (LATAM), Juicy or Yellow Card (Africa), and many more.

When selecting a payment rails partner, here are a few of the key dimensions to consider:

Geographic coverage and licensing: Does this provider have liquidity and the ability to operate in the region of interest?

Supported payment methods: Does this provider support the payment methods for on or offramping needed for your product flow?

Rates: Are they offering the above at competitive rates, not least with fiat alternatives?

From there, we must consider the chain. In order to facilitate stablecoin payments, the onramp/offramp providers and the wallet infrastructure must know which blockchain to send and hold stablecoins on. You should ensure all parts of the flow have first-class support for the appropriate chain and consider security, speed and cost as you choose what chain to build on.

Card Issuance

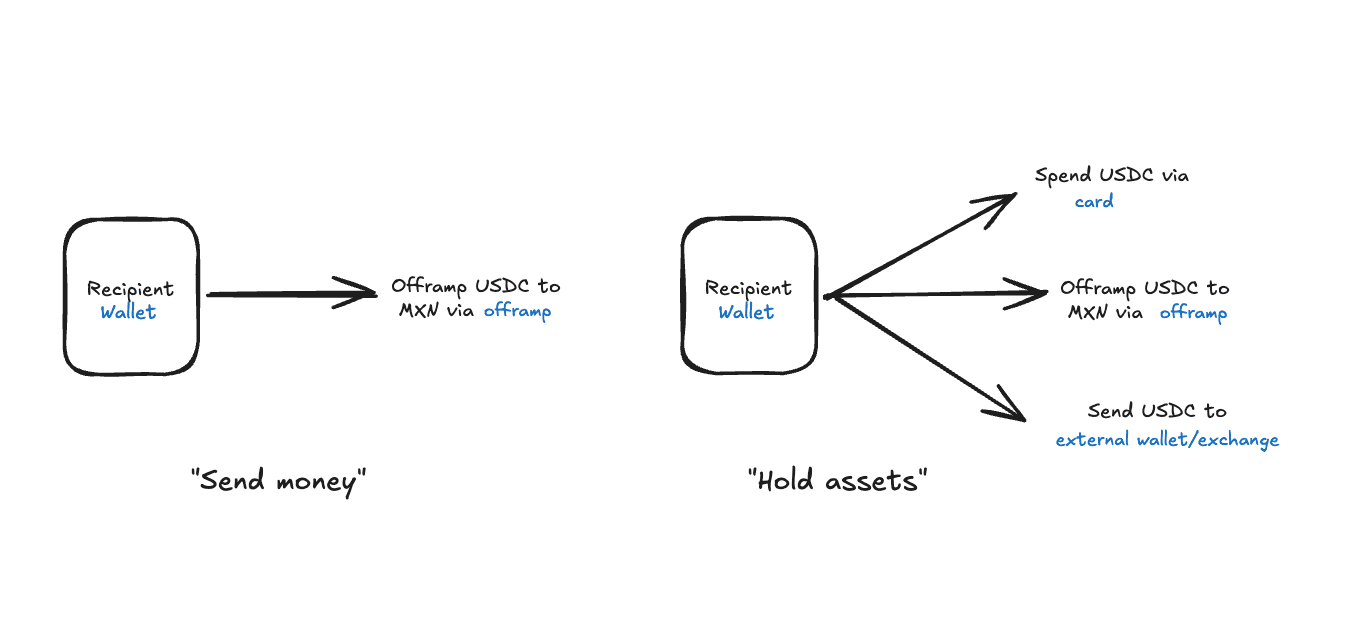

Here we split out direct card issuance atop stablecoin accounts as an effective offramp enabling users to directly spend from their stablecoin balance (wrapping the fiat conversion in a sense). Provisioning a card to allow users to spend their stablecoin balance helps solve the last-mile challenge that crypto isn’t yet broadly accepted as a payment method. Issuers like Kulipa and Rain allow users to attach a Visa or Mastercard-issued credit card to a wallet and spend down the balance locally.

When selecting a card issuing partner, here are a few of the key dimensions to consider:

Operating geography: Similar to on/offramps, issuers are geographically specialized, both with the sorts of individuals/businesses that can be issued a card, and the logistics required to deliver physical cards.

Asset support: You’ll want to ensure your issuing partner can support provisioning a limit against the specific stablecoin assets/network you’re operating with.

Interchange opportunity: Modern issuers can allow you to share in the interchange revenue earned on card spend, providing a high-margin revenue source in addition to the end-user benefit.

Where we go from here

Stablecoins unlock massive opportunities for fintechs, but standing up a payments flow requires careful consideration of cost and regulatory implications. In our next post, we’ll dive into a few practical considerations building on the stablecoin stack.

Privy builds onboarding and wallet infrastructure so you can build better crypto-enabled products. We work with neobanks, payment providers, remittance rails, consumer apps and more. If you’re looking to set up your rails for cross border payments or stablecoin ownership, we’d love to help.

====

Appendix: a quick note on offramps

A common bottleneck on stablecoin rails today is the availability of liquid offramps across geographic corridors. Specifically: will there be a ready banking partner able to move stablecoins back to fiat for your recipient at the destination? It’s one thing to be able to onramp $10B per day onto these rails, but are you able to offramp as much on the other side – after all, most merchants don’t accept stablecoins (yet) so your recipient will need fiat to spend.

Offramp availability is impacted by the regulatory regime on the ground in the recipient country (and its banks’ ability/willingness to serve digital assets), the liquidity available to crypto rails there, and more. The effectiveness of your money rail, akin to data delivery across network hops, is affected by the bandwidth of a given leg. As with the Internet, expect to see routing algorithms emerge: “programmable money” takes on its meaning.

At Privy, we see a surge in the use of direct card issuance atop stablecoin wallets: a new protocol for our routing algorithm. In practice, this makes a major difference in cost, bandwidth and utility of this rail to your customer/user.