Redefining US-LatAm cross-border money movement with Pana

How Pana uses Privy to build a borderless dollar account to expand what’s possible with remittances

Debbie Soon

|Dec 22, 2025

For millions of people across Latin America, accessing US dollars is essential. However, moving them across borders remains slow, costly, and fragmented.

Traditional remittance systems rely on correspondent banking networks built decades ago. As a result, transfers pass through multiple intermediaries, which accrue hidden fees and can also yield slow and opaque transaction statuses. In turn, senders and recipients are treated as separate endpoints rather than participants in a shared financial system.

This leads to another opportunity. Most remittance apps today optimize for the moment of transfer, but not what happens after. A user’s journey effectively ends once they are paid out.

Pana believes in a differentiated approach: remittances shouldn’t be the end of the relationship. Instead, they should be the beginning of an ongoing financial account: one that lets users receive, hold, spend, and stay connected to future flows.

What is Pana

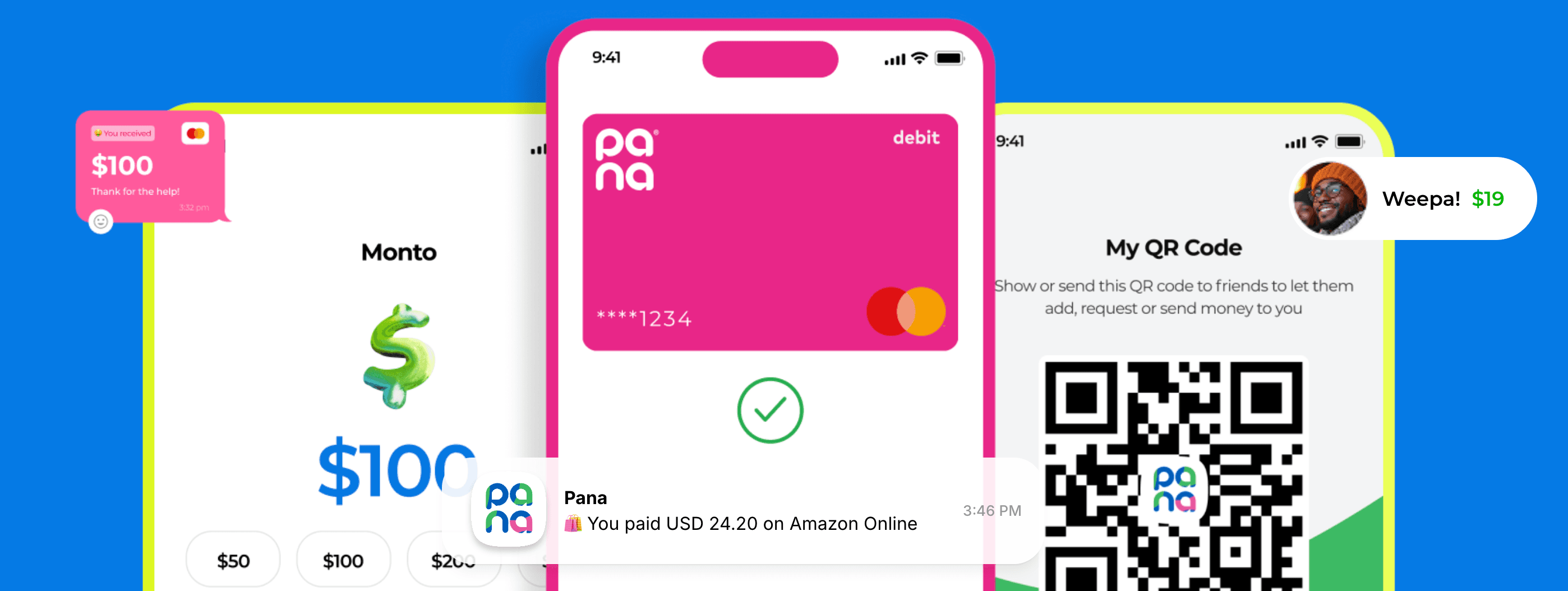

Founded in 2022 and headquartered in Miami, Pana is a stablecoin-native banking app designed specifically for the US–Latin America corridor.

Pana offers users a unified, dollar-denominated account that works seamlessly across borders. Users across Latin America can receive, save, and spend digital dollars, while US-based users can get paid directly into Pana and send money instantly to their family and loved ones.

Unlike traditional remittance apps, Pana powers both sides of the transaction:

Senders get paid directly into Pana and move dollars instantly

Recipients can spend via the Pana card or cash out locally

Funds can off-ramp to 5,000+ banks and 200,000+ endpoints across 27 countries

All activity happens within a closed-loop, account-to-account system

By backing the experience with a single ledger that syncs US banking rails and stablecoins like USDC, Pana turns fragmented remittance flows into a true global account, without users ever needing to know that they are interfacing with crypto.

This results in faster transfers, fewer intermediaries, lower fees, and a dramatically better user experience.

Pana has already surpassed 150,000 users, processed $7.2M in transaction volume in October, and ranks among the Top 10 finance apps in Honduras, Guatemala, and the Dominican Republic.

Where Privy comes in

To deliver a seamless, consumer-grade banking experience across borders, Pana needed wallet infrastructure that could abstract crypto complexity without taking custody of user funds.

Privy provides the embedded wallet layer powering Pana’s dollar accounts through a non-custodial architecture:

User-controlled embedded wallets

Each Pana user is provisioned an embedded, non-custodial wallet. Private keys are generated client-side and secured using Privy’s key management model, combining secure enclaves and key sharding so that neither Privy nor Pana has unilateral control over user funds.

Users receive secure, user-friendly dollar accounts without needing to manage seed phrases or interact with raw wallet UX. Cryptographic ownership remains at the user layer at all times.

Policy-gated server-side automation

For operational workflows such as moving funds between predefined smart contracts to support card authorization and settlement, Pana uses Privy’s server-side signers.

These signers do not custody customer balances and are not omnibus wallets. They are narrowly scoped execution agents configured with explicit policies and contract-level constraints.

They are used only to:

Move funds between predefined smart contracts

Top up card collateral contracts

Execute operational treasury actions under strict allowlists

Signer activity is constrained by programmable policies, including contract allowlists, rate limits, and role-based authorization. They cannot initiate arbitrary withdrawals or redirect user-owned assets.

User wallet balances, card collateral contracts, and platform treasury flows remain logically separated, preventing commingling of funds.

In short, end-user wallets remain non-custodial, while server-side signers function as bounded automation infrastructure.

Stablecoin-native account abstraction

Behind the scenes, Privy manages transaction orchestration, gas handling, and network interactions, allowing Pana to:

Maintain a unified dollar balance experience

Sync stablecoin rails with US banking rails

Support low-latency account-to-account transfers

Users experience a simple dollar account. Under the hood, stablecoins like USDC power cross-border movement in a programmable, non-custodial framework.

With Privy, Pana delivers the speed and programmability of stablecoin rails without exposing crypto complexity, while maintaining a clear separation between user-controlled assets and operational automation.

What’s next: from remittances to financial infrastructure

Looking ahead, Pana is expanding beyond consumer remittances into embedded financial use cases. Through SDKs and strategic partnerships, Pana is enabling banks, platforms, and creators to serve US-based diaspora communities even if they do not have a US footprint today.

Banks in the Dominican Republic are already funding customer acquisition, with six institutions signed. New capabilities on the roadmap also include payroll integrations, corridor-specific on-ramps, and card top-ups.

As stablecoins quietly replace large parts of legacy correspondent banking in Latin America, Pana is positioning itself as the account layer that connects workers, creators, families, and banks into a unified financial system. One that is built on modern rails and designed for the realities of cross-border life.

Pana is featured in our report, "9 companies redefining payments in Latin America with stablecoins". Learn more and download the full report in either English or Spanish.