Rebuilding the energy grid with Fuse Energy

How Fuse is using Privy to power a new incentive layer for scaling physical infrastructure on Solana

Debbie Soon

|Dec 30, 2025

From AI data centers to electric vehicles and beyond, energy demand is accelerating fast, and resulting in an unprecedented pressure on our national grids. Meanwhile, the systems supplying them remain fragmented and inefficient.

For consumers, that often means volatile pricing and rising costs. For grid operators, that means slow innovation and a limited ability to balance demand in real time.

At the same time, a new category is emerging at the intersection of energy and crypto: decentralized physical infrastructure networks, also known as DePIN for short. These models rethink how infrastructure is coordinated, incentivized, and scaled, and uses crypto rails to unlock flexibility that traditional systems can’t.

DePIN is what underpins Fuse’s solution for our modern-day energy demands.

What is Fuse Energy

Founded in 2022 by former Revolut executives Alan Chang and Charles Orr, Fuse Energy set out to do something rare in the energy world: own the entire stack.

From renewable site construction and power generation to trading, supply, installations, and soon hardware, Fuse controls the full journey of electricity from source to socket.

That vertical integration eliminates layers of outsourcing that burden incumbents, allowing Fuse to:

Build solar farms 30% cheaper than industry average

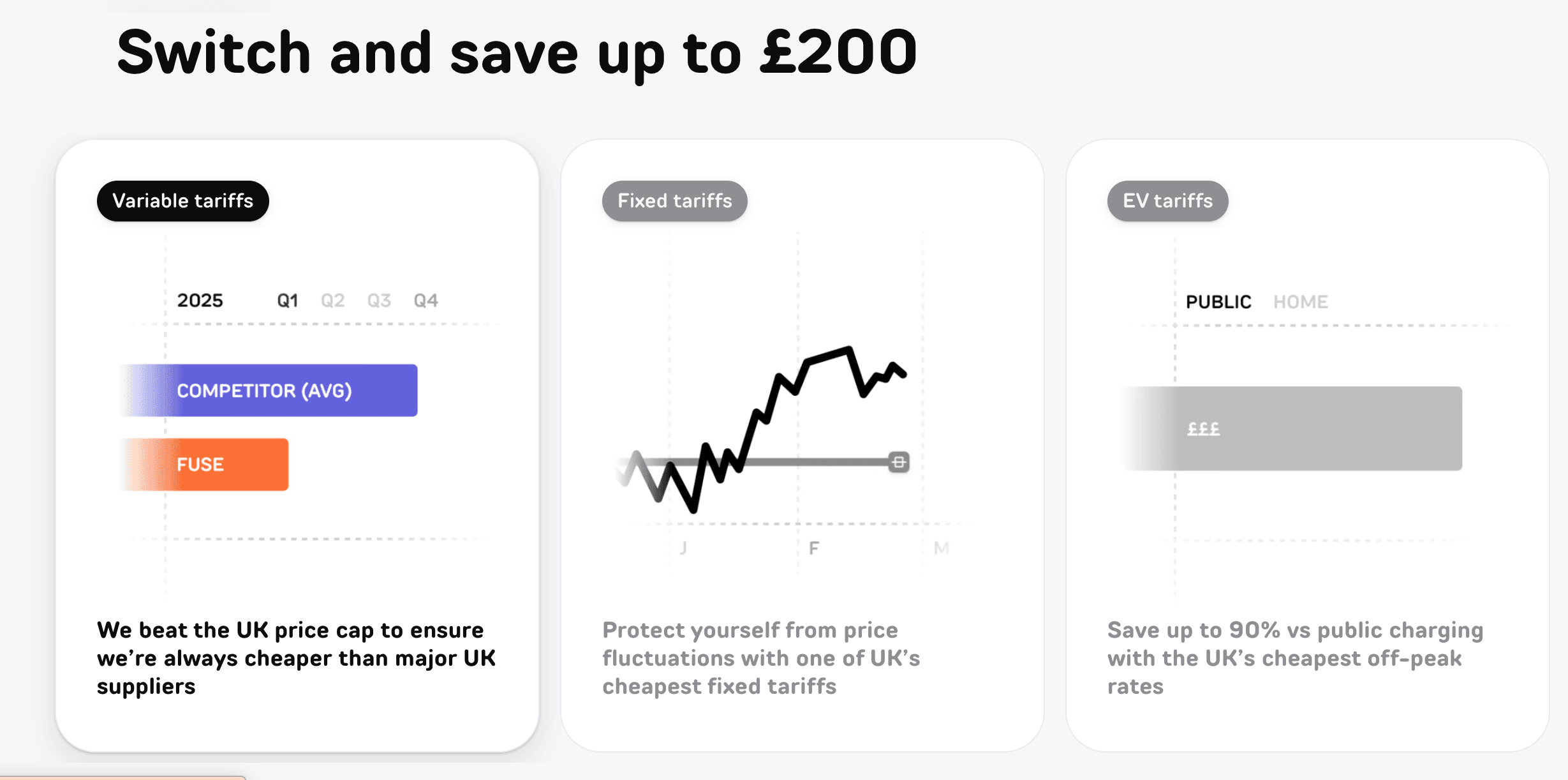

Save households hundreds on their energy bills annually

Move faster on product and pricing innovation

Today, Fuse serves more than 200,000 UK households, generates over $400M in ARR, and has achieved roughly 8× year-over-year growth, all while reaching cash-flow positivity.

In its third year of operations, the London-based company raised $70M in a round led by Balderton Capital and Lowercarbon Capital, valuing Fuse at $5B and fueling its next phase of expansion.

Making incentives work at grid scale

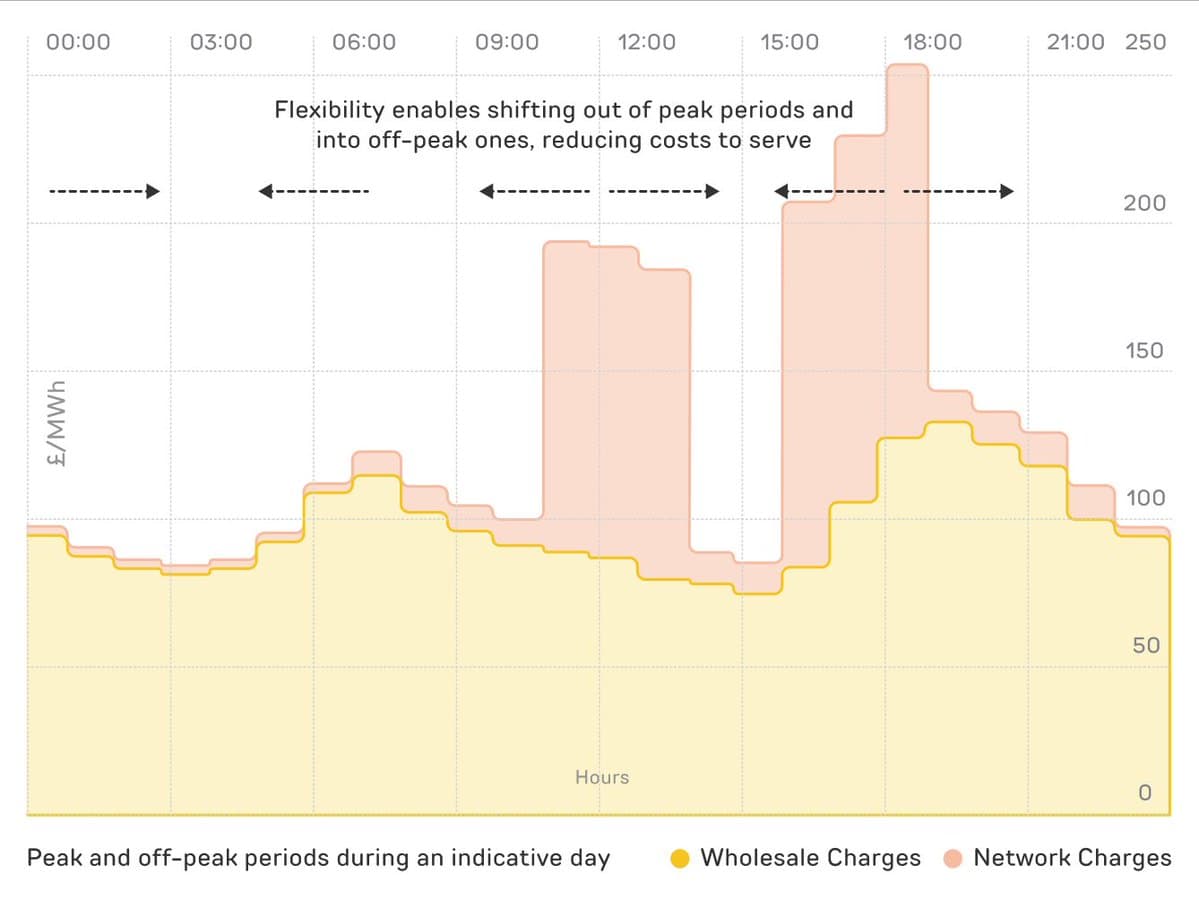

Fuse Energy believes that a sustainable energy future is made possible by intelligent, scalable grid systems that can respond dynamically to demand, instead of relying on blunt pricing and excess capacity. As such, they are building The Energy Network, a coordination layer for distributed energy resources that turns flexibility into an economic asset.

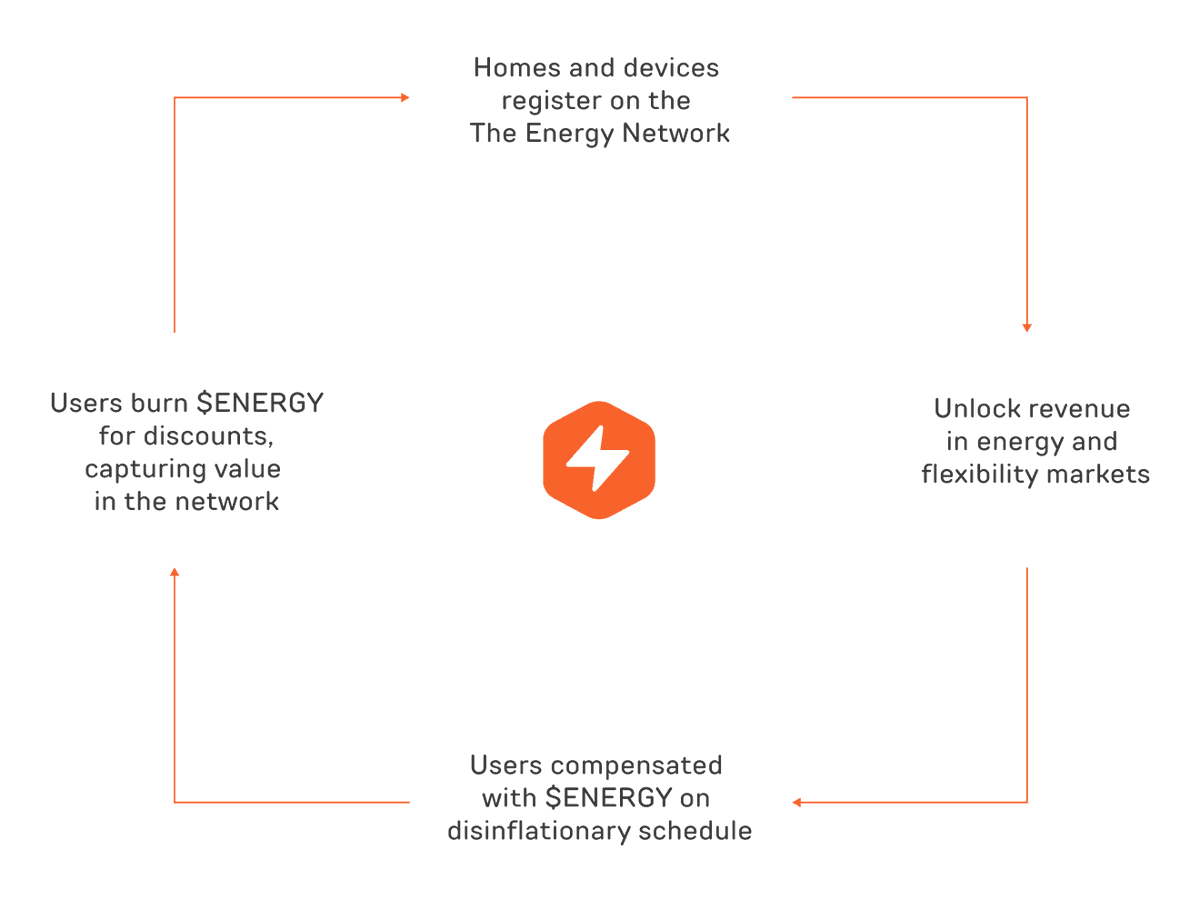

At the center of The Energy Network is $ENERGY, a tokenized incentive layer that measures, rewards, and returns the value created when users consume energy at the right times.

The model is simple but powerful. Households opt in by connecting devices, e.g. EV chargers, home batteries, thermostats; or by manually shifting usage through the Fuse app. Fuse continuously reads wholesale prices, network charges, and real-time system stress to identify when shifting demand creates value. That flexibility is dispatched into energy and grid-support markets, reducing congestion and volatility. Once outcomes settle and their economic impact is verified, users are rewarded with $ENERGY tokens proportional to the value they helped generate. These rewards can then be redeemed for discounts and access across the Fuse ecosystem.

Under the hood, Fuse Energy coordinates real-world hardware with real-time software. Devices stream live usage data, while Fuse optimizes dispatch across its vertically integrated energy stack. Incentives are then settled efficiently on the Solana blockchain, which was chosen for its low cost, high throughput, and minimal overhead relative to the physical systems it supports.

As more solar, storage, and EV infrastructure comes online, the Network scales alongside it, making flexibility a first-class grid resource, and ensuring the value it creates flows back to the people powering the system.

How Privy provides identity, wallets, and delegation

For users to hold, earn, and spend $ENERGY easily, Fuse Energy required wallet infrastructure that could:

Support a large, mainstream user base (200k+ customers)

Remove onboarding friction

Preserve self-custody

Integrate cleanly into existing consumer experiences

Building a new energy model from the ground up requires infrastructure that can keep up. As Fuse set out to revolutionize how energy is coordinated and incentivized, they needed a partner with enterprise-grade infrastructure that could grow reliably alongside them.

“Fuse is one of the first established energy players to enter the digital asset space, so it was important to partner with a credible, well-established team. Privy felt like a natural option.” — Alan Chang, CEO of Fuse Energy

A product operating at this scale also demands a seamless onboarding experience. Privy enables Fuse to offer social login–based access that removes seed phrase complexity, while still preserving full self-custody for users.

“We obsess over product. Privy’s seamless UX helps us remove friction for users while keeping the flexibility and control we need across our workflows.” — Alan Chang

What’s next for Fuse

With fresh capital and infrastructure in place, Fuse is moving fast. Over the next 6–12 months, the company plans to launch The Energy Network to general availability, introduce plug-and-play hardware kits for earning $ENERGY, expand into commercial energy, and enter three new international markets: Ireland, Spain, and the US.

For Fuse, crypto isn’t a side experiment. It’s a core enabler of a more flexible, resilient energy system where participation is measured, rewarded, and scaled in real time.

And for Privy, this work reflects a broader shift: wallets are becoming the global account for users to manage digital assets, which gives anyone and everyone a simple, secure way to participate in new incentive systems that power real-world networks. With Fuse, that shift may begin with energy, but also sets a practical blueprint for applying DePIN models to other real-world systems.