Making private markets tradable with Ventuals

How Ventuals is democratizing access to private market exposure with Hyperliquid’s HIP-3 and Privy

Debbie Soon

|Aug 13, 2025

For most, the opportunity to invest in breakout tech companies like OpenAI or SpaceX has historically been out of reach. Access was limited to founders, VCs, and institutional insiders, while the rest of the market watched from the sidelines.

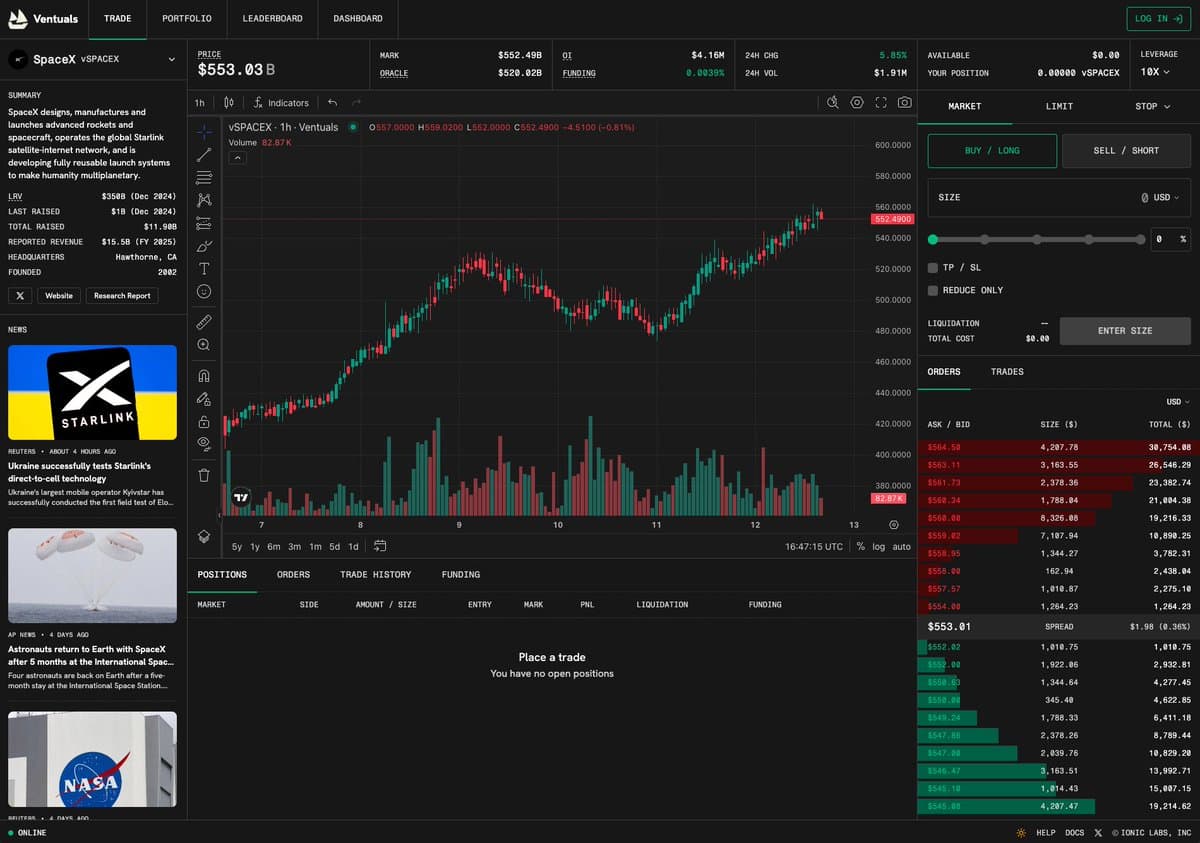

Ventuals offers a different path. By creating perpetual futures (otherwise known as perps) tied to private company valuations, Ventuals gives anyone the ability to express a view on the trajectory of companies they follow closely. No cap table access required. No IPO necessary for a liquidity event.

Perpetuals are a type of futures contract with no expiration date. Rather than settling at a fixed point in time, they use a funding mechanism to stay in line with an external reference price. This makes them well suited to track evolving valuations and market sentiment.

With Ventuals, these instruments are applied to a new domain: private markets. What was once illiquid and gated becomes observable, tradeable, and accessible. A new paradigm built on open infrastructure and shaped by user conviction.

Built on Hyperliquid’s HIP-3: A new standard for launching markets

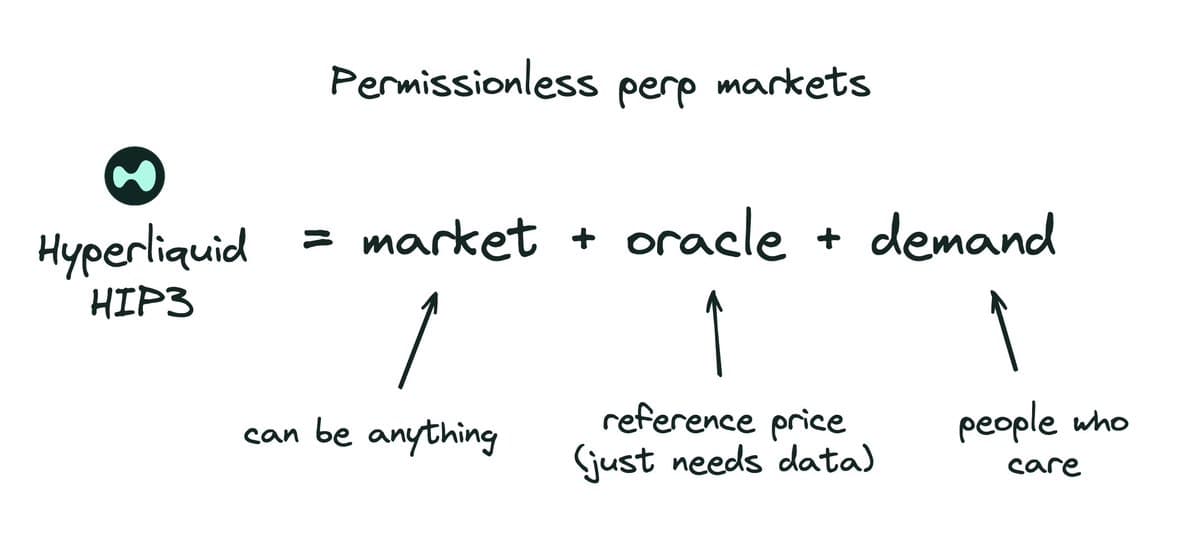

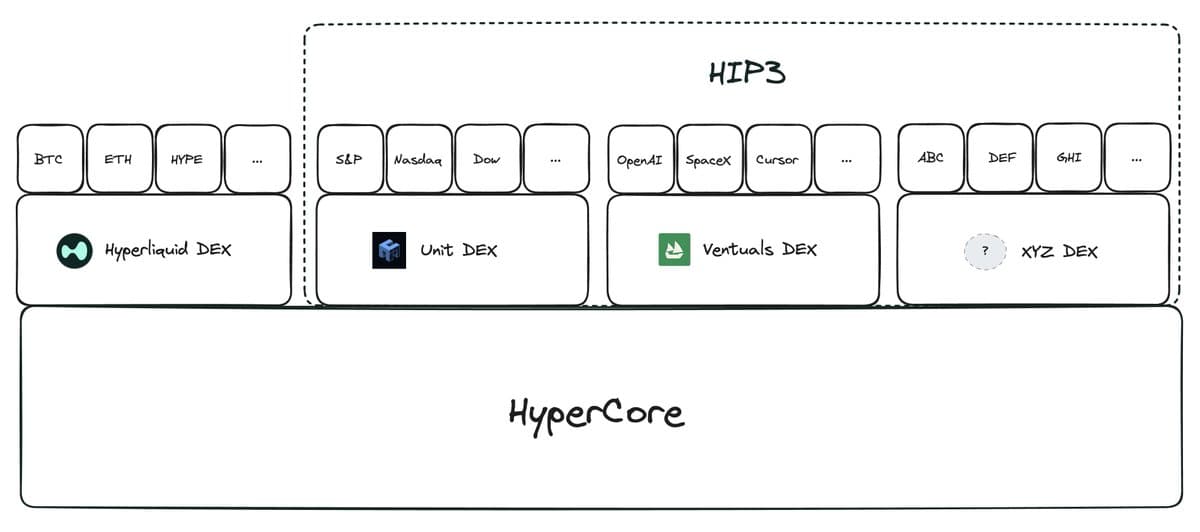

Ventuals is powered by HIP‑3, a new market primitive from Hyperliquid that lets builders spin up perp markets without rebuilding an exchange.

Hyperliquid is a performant Layer 1 blockchain purpose-built for onchain finance. With a custom consensus protocol (HyperBFT), native trading infrastructure (HyperCore), and an Ethereum-compatible smart contract layer (HyperEVM), Hyperliquid supports one-block finality and over 200,000 orders per second. This makes it an ideal foundation for permissionless, high-performance trading.

With HIP‑3, builders like Ventuals define the core parameters of a market:

What’s being traded

How it’s priced

Who it serves

Hyperliquid on the other hand handles the infrastructure: matching, settlement, leverage, and routing flow through a global liquidity layer.

This frees Ventuals to focus on market design, transforming markets that were once private and opaque into ones that are observable and tradable. Rather than relying on quarterly reports or closed-door valuations, these markets are shaped by fast-moving signals: product velocity, user traction, and public perception. And for the first time, they’re open to participation by anyone.

Integrating Privy

While HIP‑3 removes the technical barriers to launching markets, getting users into those markets seamlessly is just as important, especially during a fast-moving testnet phase.

That’s where Privy comes in. Ventuals uses Privy server wallets to create and fund wallets behind the scenes, letting users start trading with just an email or social login, with no extensions or manual setup required.

Server wallets are embedded wallets managed securely on the backend, giving developers control over orchestration and funding while allowing users to export their keys when ready. This makes them ideal for production use cases that require both smooth onboarding and long-term portability.

With Privy, Ventuals is able to:

Onboard users instantly via email or social login

Eliminate friction around wallet setup and signing

Load wallets with testnet funds automatically

Maintain trust and recoverability without sacrificing control

For early users, the experience is seamless. For Ventuals, it’s a foundation for rapid iteration and accessible market design.

“Privy offered everything we needed to build a smooth onboarding experience for both crypto and non-crypto users. It let us focus on streamlining product without compromising on security or portability.” — Emily Hsia, CTO of Ventuals

What's next for Ventuals

Ventuals is currently live on Hyperliquid testnet, where users can trade synthetic valuations of private companies with up to 10× leverage. Behind the scenes, it runs its own oracles, blending off-chain valuation data with real-time perp pricing to enable robust, market-driven price discovery.

As HIP‑3 rolls out more broadly on mainnet, Ventuals is preparing to expand its coverage across more companies and novel market types.

“We’re gearing up for our mainnet launch and are excited to push the boundaries of what’s possible with perps, both in the types of markets you can create and in delivering a dramatically improved trading experience.

Today, perps are mostly limited to advanced crypto-native traders, but we believe the UX can be simplified to be accessible to a much broader audience.” — Alvin Hsia, Co-founder of Ventuals

At Privy, we’re proud to support Ventuals in building more accessible and transparent markets, powered by open protocols like Hyperliquid.

If you're building on HIP‑3 and need wallet infrastructure to help users get started, read our docs and start building.