Earning high yield on your savings with Nook

How Privy powers seamless onboarding and secure wallets for stablecoin savings at scale

Debbie Soon

|Aug 21, 2025

Today, even so-called “high-yield” savings accounts at traditional banks pay just 4–5%. For savers looking to do better, there’s now a simpler alternative, and it starts onchain with stablecoins.

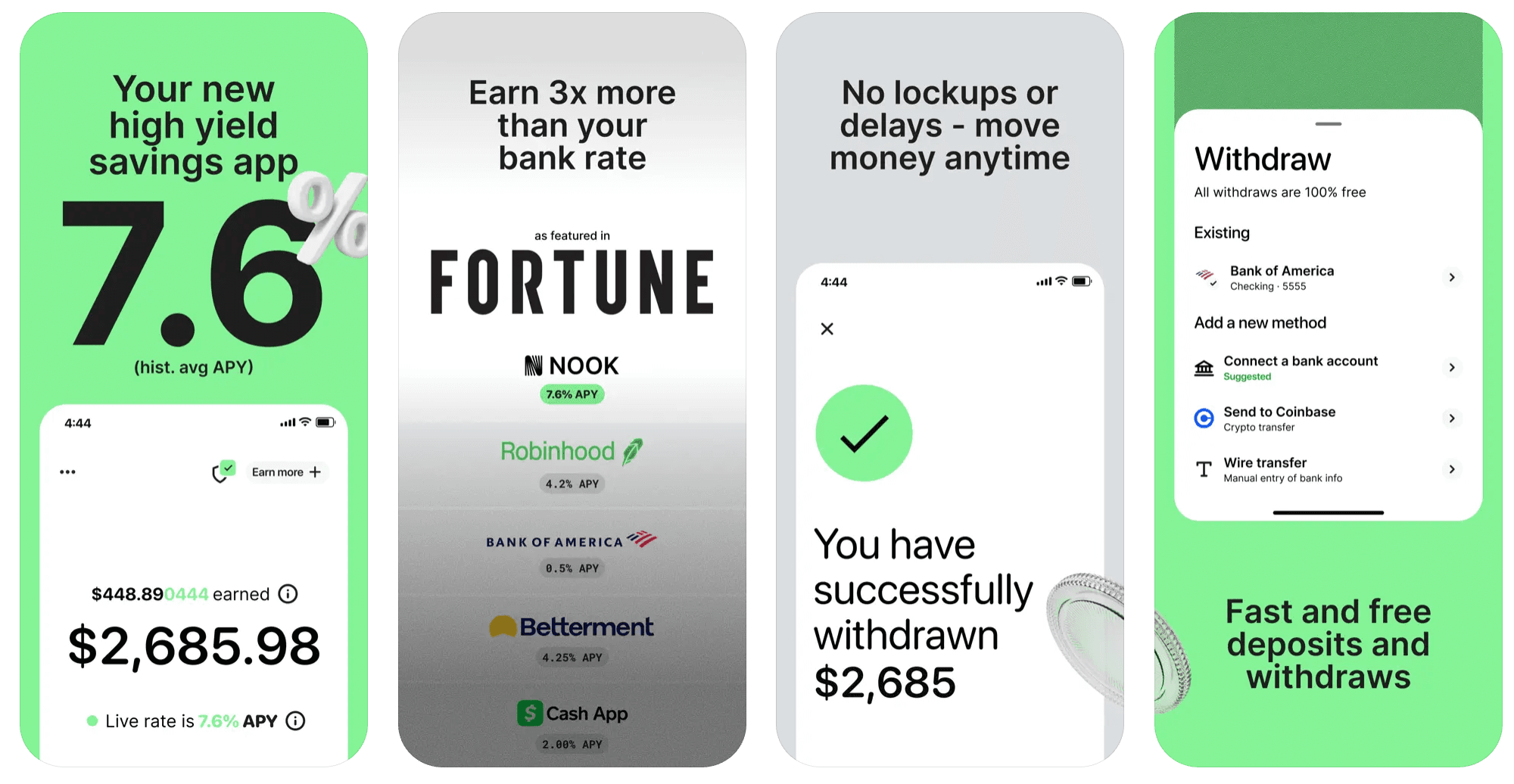

Nook is a high-yield savings app that taps into the crypto market to help everyday savers earn more on their money. Through partnerships with Coinbase and trusted DeFi protocols, Nook makes it possible for anyone to deposit cash, convert it into stablecoins like USDC, and earn yields as high as 10-15%, all from a clean, beginner-friendly and mobile-first interface. Since launching, Nook has delivered an average of 7.6% APY over the past 12 months, demonstrating a significant outperformance over traditional banking institutions.

“Nook makes it really easy for customers to access high yields for their dollars through DeFi and a self-custodial wallet powered by Privy. By converting deposits into stablecoins, our rates are currently sitting at around 25–30x the bank rates. We believe we offer the highest rates for savings among any app within the App Store.” – Joey Isaacson, Co-founder and CEO of Nook

Behind the scenes, every loan is fully collateralized. Borrowers put up valuable crypto assets, and if they fail to repay or their collateral falls in value, it’s liquidated to protect lenders. The result is simple: users earn higher yield on stablecoin deposits with stronger transparency than in most traditional accounts, without having to touch or interact with complex DeFi tools themselves.

How it works

At its core, Nook is powered by decentralized finance (DeFi). DeFi protocols are like open financial marketplaces: some people want to lend assets to earn interest, others want to borrow assets to trade or invest. Smart contracts manage the entire process automatically.

Here’s how it plays out inside Nook:

1. Convert your cash

Nook partners with Coinbase to convert deposits into USDC, a stablecoin pegged 1:1 to the U.S. dollar.

2. Deposit your funds

From there, your money is supplied to vetted DeFi lending protocols, such as Moonwell, Morpho, and Aave. This makes you, the Nook user, a lender.

3. Borrowers enter the system

On the other side, crypto traders or investors borrow those stablecoins. To do so, they must post valuable collateral (like ETH or BTC).

4. Protection for lenders

If a borrower can't pay back the loan or their collateral loses value, the protocol automatically sells the collateral to pay off the loan. The borrower takes on the risk, while you, the saver, keep getting interest.

5. Earn and move funds anytime

Interest from borrowers flows back to you as yield. Over the past 12 months, Nook savers earned an average 7.6% APY, significantly higher than traditional bank accounts. And because there are no lockups, you can withdraw instantly to your bank or Coinbase account.

With this arrangement, Nook gives you the benefits of DeFi lending that uses stablecoins: better returns, real-time transparency, and self-custody, all without the hassle of external wallets, seed phrases, or protocols.

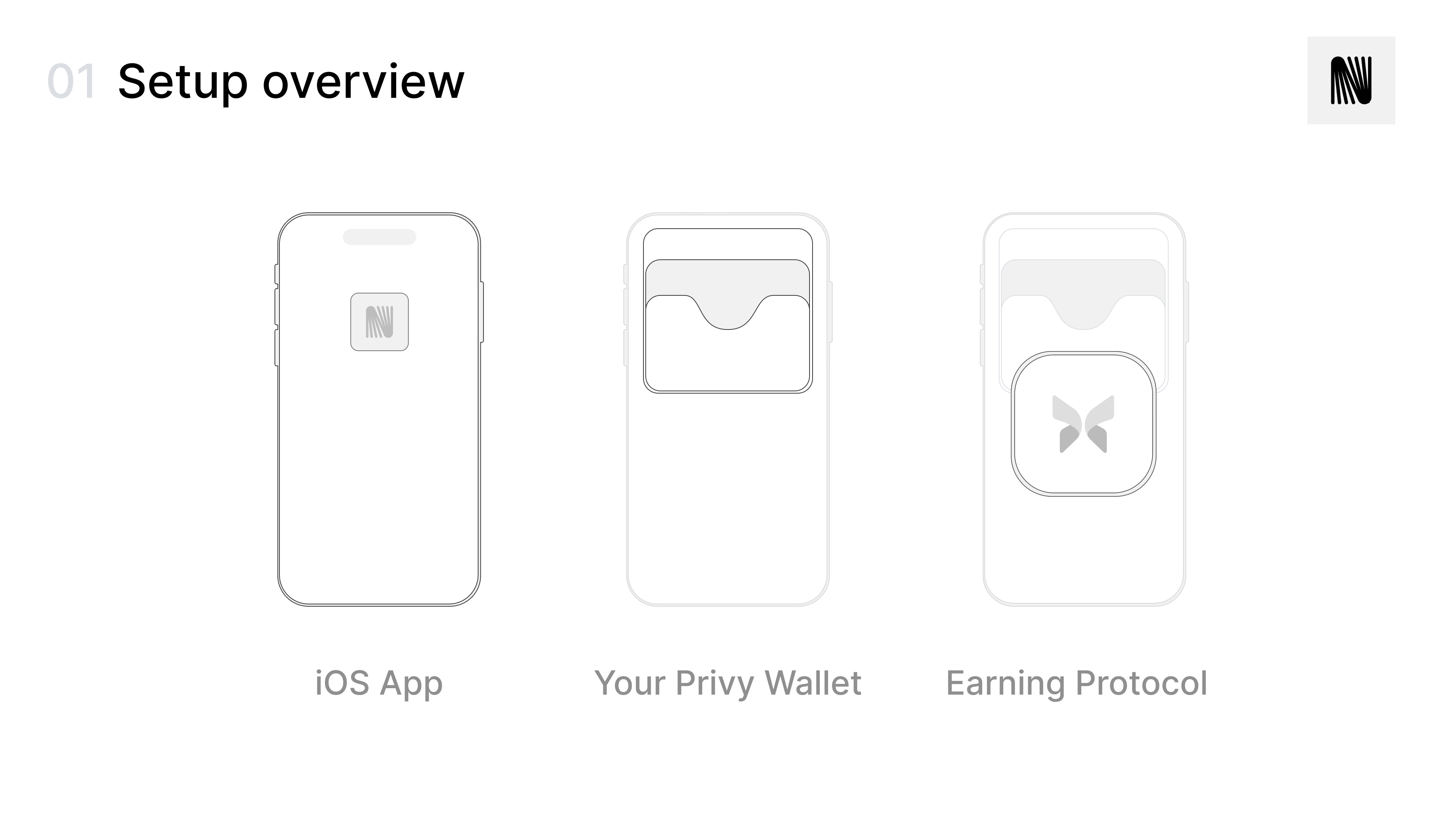

How Privy comes in

Privy powers the wallet layer that makes Nook possible. Every Nook user is provisioned with a self-custodial wallet at signup, embedded directly into the app.

Privy handles:

Secure wallet creation and key management at scale

Seamless deposits and withdrawals, integrated with Coinbase

Account recovery features, giving users confidence their savings are safe

By relying on Privy, Nook can focus on building a best-in-class savings product while offering users real yield with institutional-grade security.

“Privy made it really easy to get things off the ground. Between managing smart wallets, embedded wallets, excellent docs, and responsive support, it’s been straightforward to use, and helped us get our product live quickly.” – Sohail Khanifar, Co-founder and CPO of Nook

What’s next for Nook

Nook is growing fast: expanding beyond its iOS launch and adding support for new platforms and geographies. Android and international availability are coming soon, opening access to high-yield savings for a global audience.

On the product side, Nook is constantly adding more choices of vetted DeFi protocols, giving users broader access to yield opportunities while maintaining strict standards for security and transparency.

As Nook scales, Privy is excited to continue powering its secure wallet infrastructure, ensuring every saver has a reliable, transparent, and simple way to earn more on their money.

Download the Nook app from the App Store today, or talk to us if you too are looking to build an app on stablecoin rails.