Turning wallets programmable with Privy’s policy engine

A guide to how policies can be used to enforce intent, reduce risk, and unlock new use cases

Debbie Soon

|Jan 8, 2026

Wallets are more than just a static vault. They are dynamic accounts for holding and moving value across a growing range of applications, from fintech and trading to consumer products and beyond.

As wallets take on more responsibility, the question for product teams becomes less about what they can enable, and more about how they do so safely. How do you take advantage of everything wallets can do, without giving them unlimited power or introducing unnecessary risk?

Privy’s policy engine addresses this directly. It allows teams to define clear, enforceable rules that govern how wallets behave: what actions are allowed, under what conditions, and where the boundaries are.

In this guide, we’ll cover:

What a policy engine is and why it matters

How Privy’s policy engine works at a conceptual level

The real-world use cases it enables, from treasury management to trading systems and agentic wallets

What is a policy engine?

At a high level, a policy engine is a system for enforcing rules before an action happens.

In the context of wallets, that means every transaction, signature, or key action is evaluated against a defined set of constraints. If an action violates those constraints, it never executes.

This is fundamentally different from relying on application-layer checks. Instead of encoding wallet behavior across services, scripts, and internal processes, a policy engine makes those rules explicit and evaluates them consistently for every request.

For product teams, this changes the role wallets play. They move from passive infrastructure to governed components that can safely support more powerful workflows.

How Privy’s policy engine works

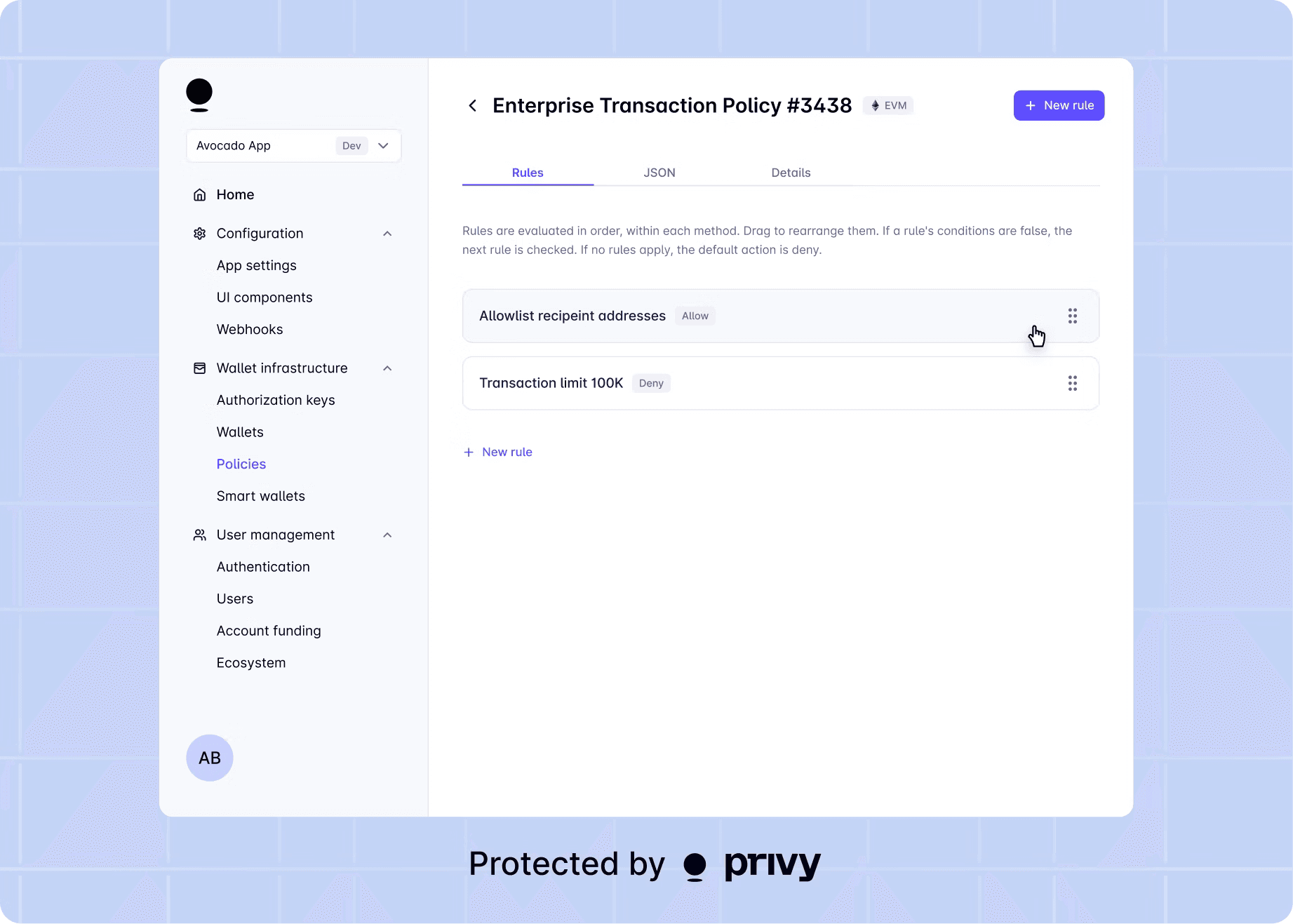

Privy’s policy engine is built around three core primitives: policies, rules, and conditions.

Policies represents what a wallet can do

A policy represents the complete set of constraints that govern a wallet.

It answers a simple question: what actions is this wallet allowed to take?

Policies are explicit, versioned, and applied at the key level. They default to deny, which means if an action isn’t explicitly allowed by the policy, it won’t be executed.

This creates a predictable, secure baseline for production systems, and one where wallet behavior is intentional rather than assumed.

Rules define actions

Within a policy, rules map to specific wallet actions, like:

Sending a transaction

Signing typed data

Interacting with a smart contract

Exporting a private key

Each rule evaluates to either ALLOW or DENY, with DENY always taking precedence.

That precedence model matters, as it lets teams introduce hard stops without worrying about unintended permissions elsewhere in the policy.

Conditions encode intent

Conditions are where nuance lives.

They are boolean checks evaluated against the contents of a wallet request. Conditions can inspect things like:

Recipient addresses and amounts

Smart contract function names and parameters

Network or program identifiers

Time-based constraints

Typed data fields used for signatures

Only when all conditions in a rule are satisfied does the rule’s action apply.

This structure gives teams fine-grained control while remaining predictable under load.

Use cases enabled by a policy engine

Privy’s policy engine is not just a security control. It is a product unlock.

Below are some of the most common and most powerful use cases teams are building today.

Treasury management and operational wallets

Treasury wallets often need to hold meaningful balances while being accessed by multiple systems or operators. In many cases, those funds are pooled in omnibus wallets, where a single wallet represents activity across users, accounts, or business units.

The risk profile here is very different from a personal wallet. A single misconfiguration can have outsized impact.

With policies, teams can:

Enforce per-transaction and aggregate transfer limits

Restrict funds to approved counterparties or settlement contracts

Require specific signing methods or approval flows

Limit which networks or programs treasury funds can interact with

The result is a treasury or omnibus wallet that can move money efficiently while remaining tightly governed.

Trading platforms

Trading platforms need wallets that are fast, automated, and tightly scoped, especially when they are executing on behalf of users.

For exchanges and trading apps, wallets often power actions like placing orders, managing positions, or settling trades. In these contexts, traders care less about unrestricted access and more about guardrails: limits, conditions, and clear boundaries around what can happen.

Policies make this possible:

Allow wallet interactions only with approved trading or settlement contracts

Constrain calldata to specific actions, such as placing or cancelling orders

Enforce limits tied to order size, exposure, or risk parameters

Restrict activity to specific networks or venues

This lets trading systems execute quickly while respecting trader intent and platform risk controls.

Agentic and automated wallets

As agentic systems become more common, wallets are increasingly being used by software rather than humans.

In these systems, intent has to be explicit. An agent can act quickly and continuously, which makes clearly defined boundaries more important than ever.

Policies let teams specify exactly what an agent is allowed to do:

Cap spend per transaction or within defined time windows

Restrict actions to a narrow set of contracts or programs

Prevent signing of arbitrary typed data

Automatically expire permissions

For example, a portfolio rebalancing agent can be allowed to move funds only between approved assets, within defined thresholds, and only during specific time windows. All this can be done without ever granting it full control of the wallet.

This turns agent wallets into constrained executors that operate within well-defined limits, making autonomous systems practical to deploy in production.

Bringing it together

Across treasury operations, trading platforms, and agentic systems, the pattern is the same: as wallets take on more responsibility, intent has to be encoded directly into how they operate.

Privy’s policy engine gives teams a way to turn assumptions into enforceable rules, thereby making wallet behavior both powerful and predictable by design. The same primitives that govern a treasury wallet can also support delegated actions, consumer safeguards, or compliance-aware flows, without changing the underlying model.

Today, Privy’s policy engine is available across EVM- and SVM-compatible chains, and can be created and managed at whatever level makes sense for your team, be it directly through the Privy Dashboard, or via our Node SDK or REST API.

As wallets become the default account layer for digital value, policies are what make them safe, flexible, and predictable enough to support real-world use at scale.