How blockchains simplify transactions

Madeleine Charity

|Dec 4, 2024

Cutting complexity in the financial system makes transactions less expensive for both the customer and merchant. Blockchains support internet-native currency which simplifies how money moves on the web.

In this post, we will explore at a high-level how blockchains simplify financial infrastructure. To understand where exactly the cost savings come from, we will examine the steps to execute a point of sale transaction with and without blockchains.

Introduction

Attempting to translate physical currency, a concept that was invented thousands of years ago, onto the internet is unnatural. Copying information from (sometimes paper) ledgers into databases and back is lossy across hundreds of billions of dollars in transfers. Existing payment systems are overly complex for the modern high-volume global economy; it’s time for something new.

A blockchain is a shared piece of data on the web which anyone can read or write to; it is not owned by any single party. Blockchains support financial infrastructure as a public good. Decentralized systems built on blockchains reimagine how money can move with the speed and efficiency of the internet.

Breaking down the point of sale transaction

Let's look at how both financial systems execute a transaction from point of sale, side by side, to see how blockchains simplify the payment process.

Legacy system

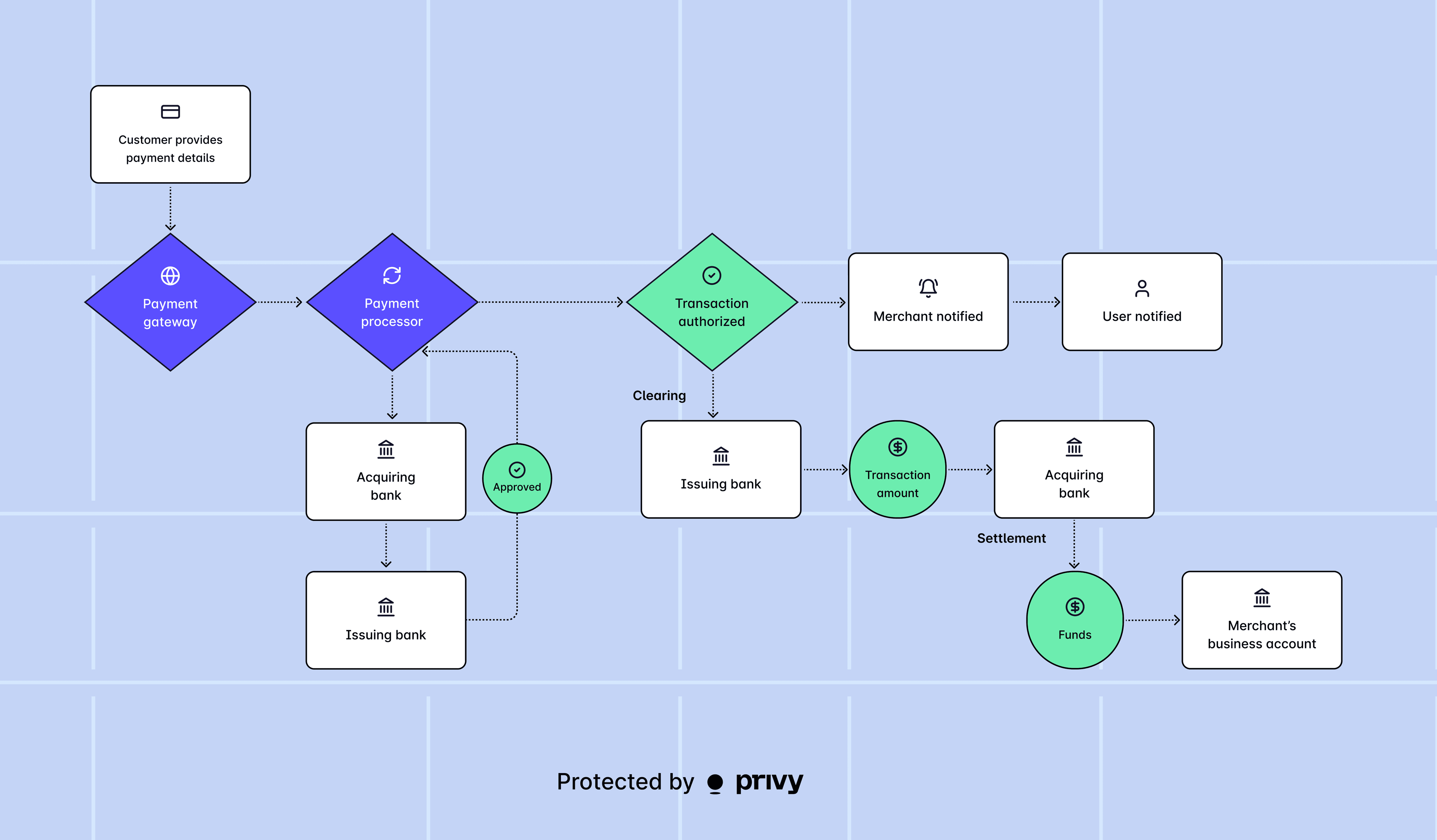

Below are the steps involved in executing a transaction with centralized financial services, paraphrased from Stripe’s website.

(Initiation) The customer provides their payment details to the business.

(Encryption and transmission) The payment information is securely transmitted to a payment gateway, which encrypts the data and forwards it to the payment processor.

(Authorization) The payment processor sends the transaction details to the acquiring bank (the business’s bank), which forwards the information to the issuing bank (the customer’s bank) through the relevant card network. The issuing bank verifies the customer’s account and checks if they have sufficient funds or credit to complete the transaction. Then the issuing bank sends an approval or decline message back to the payment processor.

(Response) The payment processor relays the transaction’s approval or decline status to the business, which then informs the customer of the outcome.

(Clearing) Once the transaction is authorized, the clearing process begins. The issuing bank transfers the transaction amount (minus any applicable fees) to the acquiring bank.

(Settlement) During the settlement process, the acquiring bank deposits the funds into the business’s account. The business receives the payment, and the transaction is considered complete.

(Reporting and reconciliation) The business and financial institutions review and reconcile their transaction records, ensuring accuracy and addressing any discrepancies.

Decentralized system

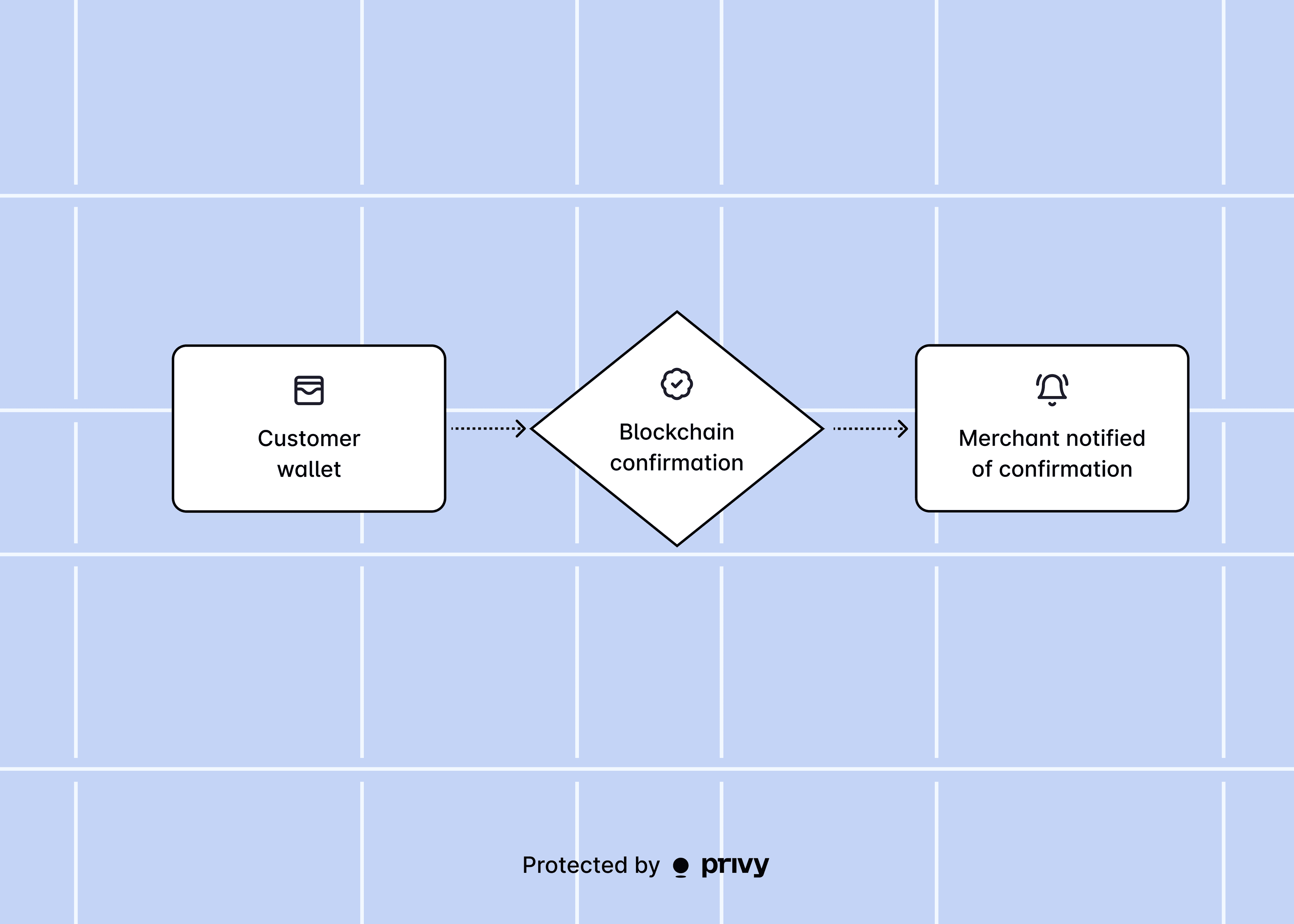

Compare those seven overly complex steps to the few simple steps needed to execute a transaction on blockchain.

The merchant creates a transaction to prompt the transfer of funds from the customer's wallet to the merchant's wallet.

The customer approves the transaction, which is signed by their wallet and broadcasted to the blockchain.

The blockchain confirms the transaction programmatically at the protocol level.

The merchant sees the transaction confirmation on the blockchain and knows their wallet has received payment.

The bottom line

Customers and merchants shouldn't have to pay for their money to move in inefficient ways. The cost for an online payment from Stripe is 2.9% of the transaction + $0.30. The cost of a blockchain transaction is $0.036 (avg Solana, gas fee, from Coincodex). Fundamentally, moving money from one account to another is not worth 3% of the value of that transaction– blockchains provide a better way.

Why now?

If blockchains are simpler, cheaper, and more efficient, then why are we not already using them for payments? It takes time to build and adopt new technologies, but now the major hurdles have been overcome.

Until recently, blockchains were difficult for both developers to build on and consumers to use. Simplifying this complexity is what motivates us at Privy and a lot of the user and developer experience problems are now solved.

Entrenched interests of existing parties and reputational drawbacks of the industry can make it difficult to get majority buy-in, but sentiment is shifting as people understand the strong value blockchains have to offer.

To be credible financial infrastructure, blockchains need both asset liquidity and stable regulation, both of which took time to develop but have come to fruition in the last few years.

Because of blockchains’ unique ability to execute borderless transactions, the use cases that will adopt decentralized rails first will be moving money internationally. Some of our favorite projects include:

Bridge and BVNK facilitating global money movement via stablecoins.

ImpactMarket using cryptocurrency rails to distribute UBI and microcredit.

DolarApp offering USD-denominated banking solutions to users in Latin America.

Closing

In the past, we needed centralized financial services to translate the concept of physical cash online, which is inefficient and expensive. Blockchains facilitate the payment system of the future by supporting simple transactions with much lower costs. Switch to decentralized financial rails for cheaper, simpler, and faster payments.