How money moves onchain

Madeleine Charity

|Jan 7, 2025

The advent of the web allowed us to quickly and efficiently move information around the world. Now, distributed systems offer us a better way to securely move monetary value with the same lightning speed. This means global payments that work across currencies cutting out a number of intermediaries to simplify the global financial rails and offer faster, cheaper payments for businesses and consumers.

Blockchains can enable seamless business to business and peer to peer transactions, but these transactions are supported by a complex technical stack. Thankfully, this stack is rapidly being simplified and there has never been a better time to build decentralized applications. Developers no longer need to deal with all the complexities of blockchain to build on them. Products like Privy embedded wallets abstract away low level technical details and allow apps to easily manage users and their assets.

Yet, understanding how value moves onchain remains a challenge for developers. In this post, we break down onchain funding end-to-end, so you can make sense of the noise and build better products. Use this blog post as your cheat sheet to understand how fiat currency moves on chain, how digitized value moves between different assets, and everything in between.

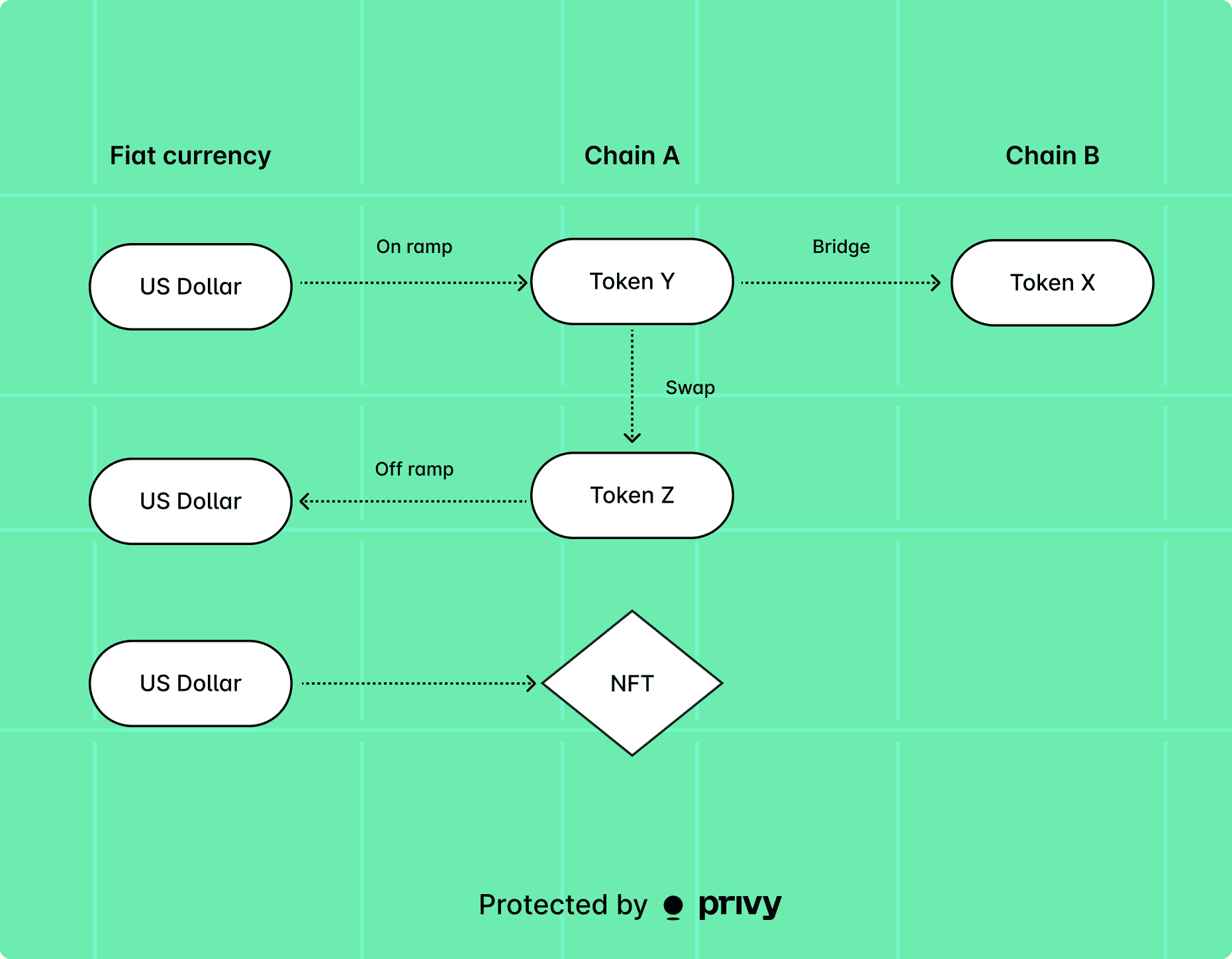

From fiat to crypto

To use decentralized financial systems, users must first move value onchain. In this section, we will cover the mechanisms that allow currency to move on and off blockchains, including onramps, offramps, and NFT checkout.

Onramps

What: Onramps refer to the process of moving government-backed currency into tokens on the decentralized internet.

Why: The first step to using decentralized financial systems is to move value onchain; onramps are the clear entry point into transacting onchain.

How: Services like Moonpay and Coinbase enable users to purchase cryptocurrency using credit and debit cards.

Currently in the US, onramping is the highest-friction point in the user onboarding process. To purchase a digital asset that is considered a security, users must complete the Know Your Customer (KYC) process, which is used to verify their identity and ensure they are acting legally.

To have an onramping flow in your product experience, you will need to decide which provider to integrate in your app. When choosing a vendor, consider:

KYC requirements your users will need to complete

Minimum transaction amounts

The states or countries the vendor is licensed in. In the US, companies moving funds require a money transmitter license. These licenses may apply at both the federal and state level; for example, the state of New York requires a BitLicense to move digital currency.

As you grow you may need to integrate multiple vendors. Stay opinionated about which provider your app offers so users aren't forced to make choices they are not equipped to make.

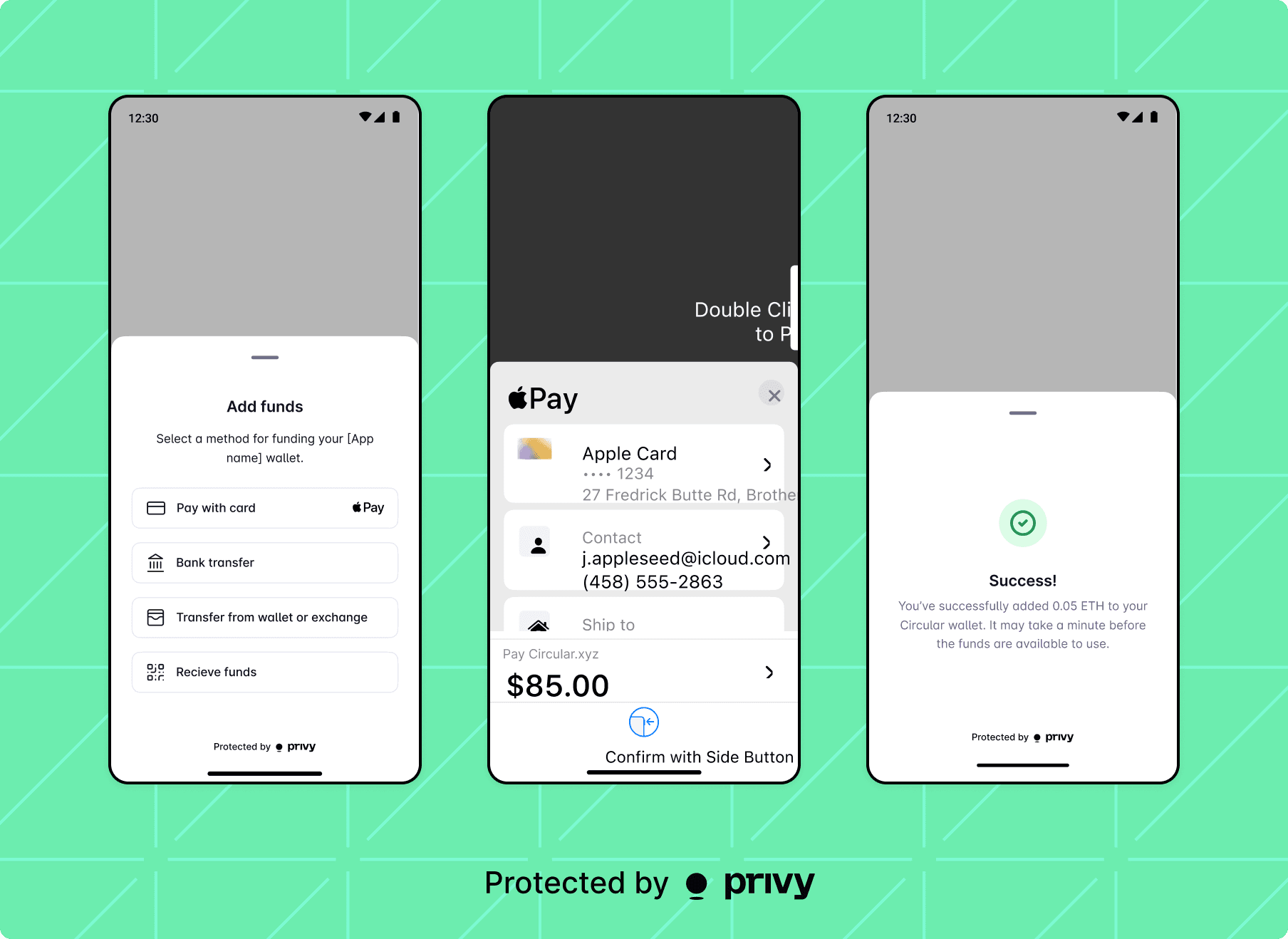

What's next: Apps need simple, frictionless onramping flows—including using Apple pay—to enable seamless in-app payments. Privy makes it easy to onramp fiat into wallets with out-of-the-box support for paying with card, Apple Pay, and Google Pay.

Offramps

What: A mirror image of onramps, offramps enable users to convert onchain assets back into fiat currency.

Why: Users need to know they have a way to move value back into fiat currency. Offramps are important in ensuring users can always move their assets back into traditional banking services.

How: Similar to their onramp services, Moonpay and Coinbase allow users to transfer their onchain tokens back into government backed dollars.

Worth noting: Stablecoins can enable simple means of holding onchain value as a fiat-like equivalent for longer. For instance, the recent Bridge/Coinbase collaboration enables people to open USD bank accounts with their wallets. This is particularly exciting in countries where the local currency is volatile and consumers may prefer to hold stablecoins pegged to the US dollar instead of immediately cashing out into fiat currency.

NFT Checkout

What: NFT checkout refers to using fiat currency to purchase an non-fungible token (NFT), a unique asset onchain.

Why: NFT checkout is another way to move value onchain; instead of purchasing a common token asset like ETH or USDC, the user receives a NFT associated with a smart contract.

How: NFTs can be bought via first or second party purchase. First party purchase refers to buying NFTs from the app that minted them. Purchases can be executed via a transaction onchain or by the customer paying in fiat and trusting the app to airdrop them the NFT. Second party purchases refer to purchasing an NFT from a different user or app than the original minter. These purchases do not have a trusted party and happen via transactions onchain.

Why this matters: In contrast with onramps where purchasing currency which is considered a security, NFTs are considered a commodity. Onramps require a money transmitter license and KYC; NFT purchases are subject to different regulatory requirements and may involve a smoother purchase process.

While it is possible to buy an NFT with currency already on chain, there are advantages to bypassing a direct token purchase. For example, traditional credit and debit card flows can be used in first party NFT checkouts. NFT checkout can simplify the user experience of making in-app purchases.

Between tokens onchain

Apps operating on different chains are like merchants operating in different countries; currency must be exchanged before trading across both countries and chains. In the next section, we will break down swaps and bridges which are important mechanisms to move value between different tokens and blockchains.

Swaps

What: Swaps refer to exchanging one token for another, when both tokens are on the same blockchain.

Why: A single blockchain can support multiple different types of token; for example, the blockchain Base supports many different tokens, including USDC and ETH. Users may need a specific token for a transaction in a different application; swaps enable them to transfer value into the token of choice.

How: Swaps are supported on centralized and decentralized exchanges like Coinbase and Uniswap.

Bridging

What: Bridging refers to exchanging one token for another when the tokens are on different blockchains.

Why: There are countless different blockchains users can have assets on. Because of this fragmentation, users may want to transfer a token from one chain to another to buy an asset that only exists on the destination chain.

How: Similar to swaps, bridging is supported by centralized and decentralized exchanges like Coinbase and Uniswap. Most chains also support their own bridging mechanisms at launch.

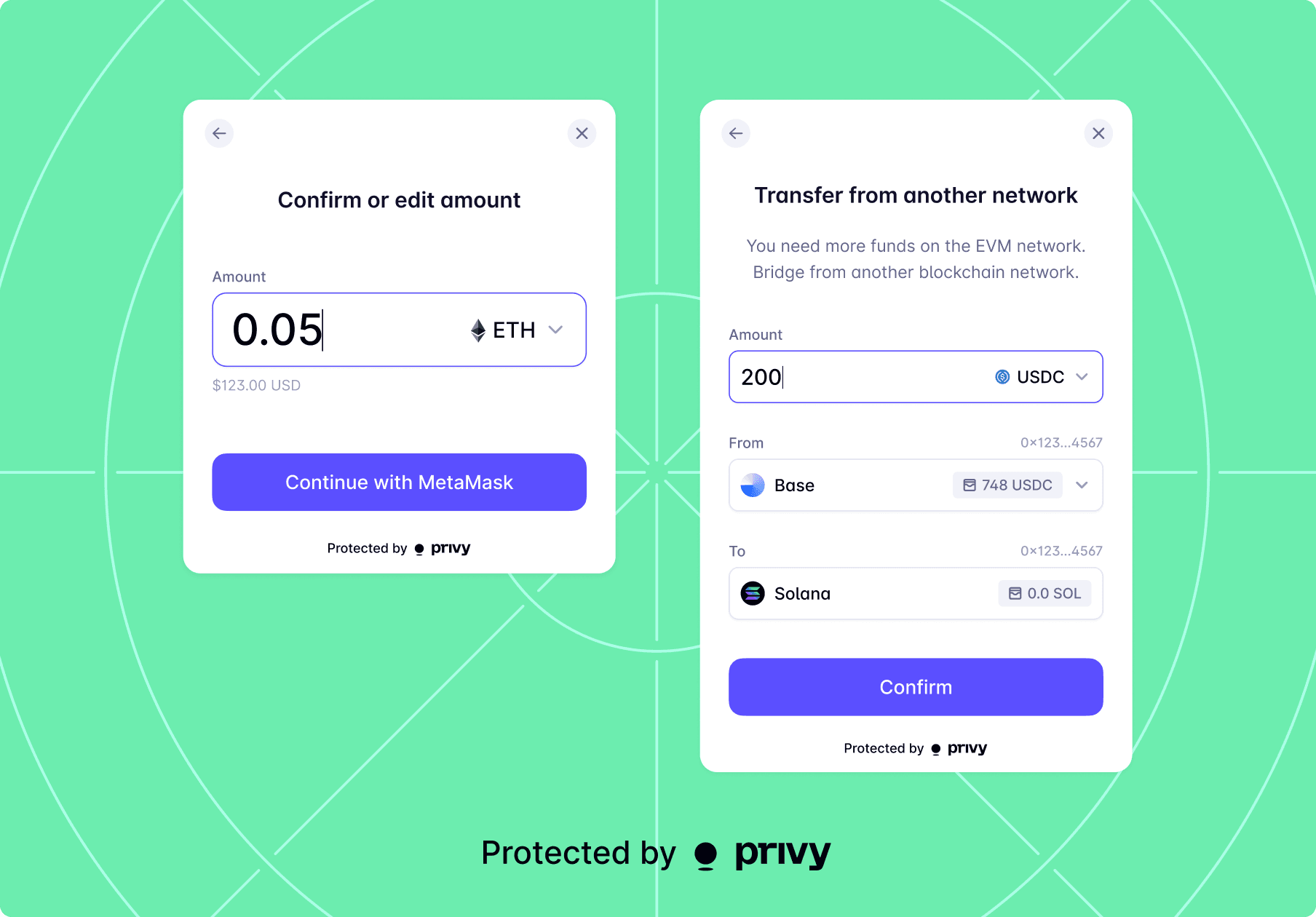

What's next: To build simple consumer apps, bridging and swapping in-app must be a seamless one click experience or automated for the user entirely.

Paying for a digital asset with cross chain tokens, without any consideration from the user, is becoming increasingly easy. Tools like OneBalance allow developers to abstract away from specific blockchains all together.

Privy makes building these cross token transfers into your app even easier, with out of the box flows for users to bridge tokens.

A note on transaction costs

Every transaction onchain has a small fee (gas) which covers the cost of running the network. These gas fees can be a nuisance for users to allocate as prices fluctuate and can be charged in a token the user is not holding.

Gas sponsorship

What: Gas sponsorship refers to having a third party sponsor the gas fees for a transaction.

Why: Dealing with gas adds friction; the fees are charged in the native token of the blockchain which a user may not have in their wallet.

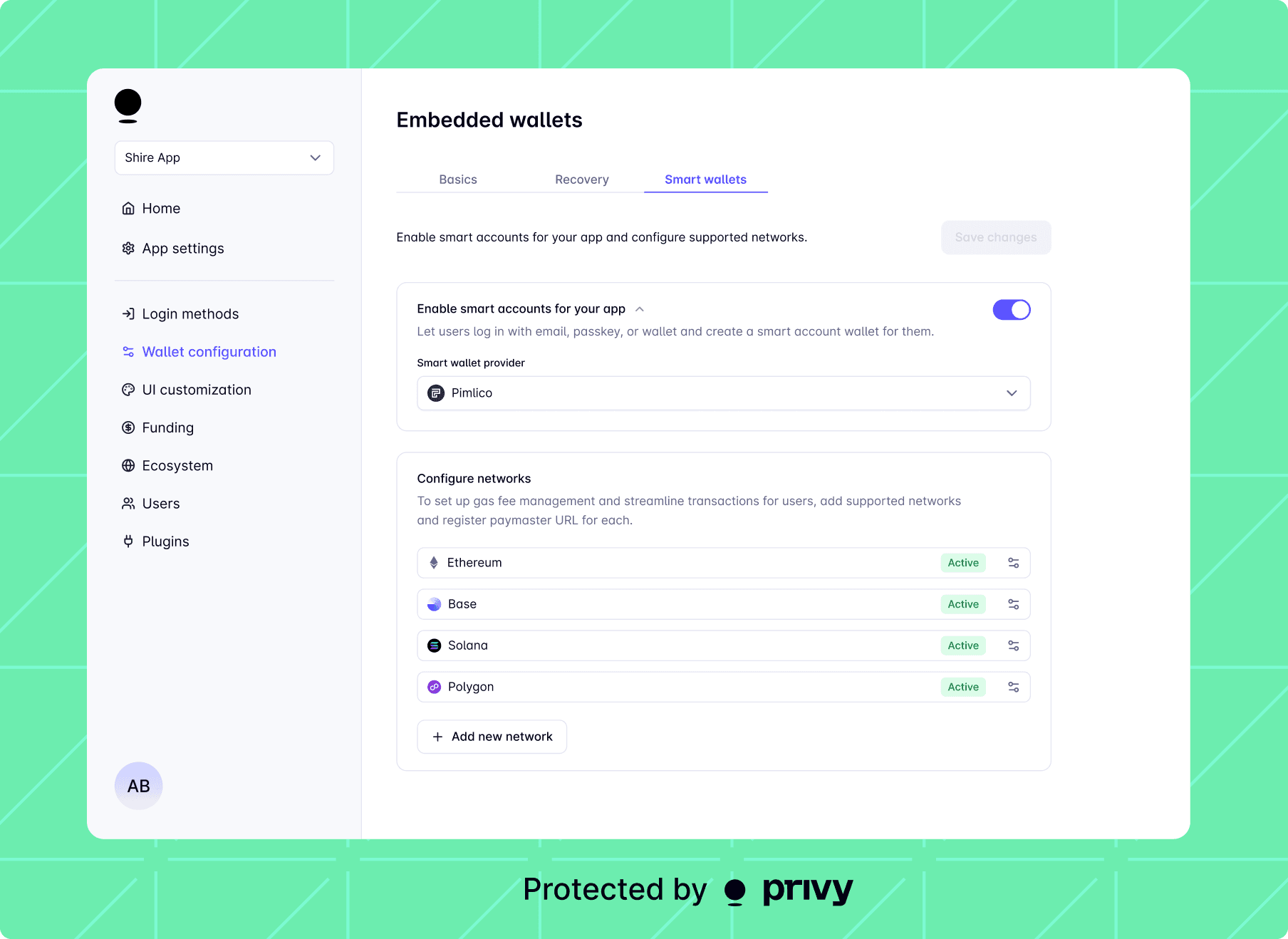

How: Gas sponsorship can be done in multiple ways. Account abstraction frames the wallet as a smart contract and the smart contract paymaster covers the cost of gas for the wallet. Another approach is using a relayer to submit transactions to the network so it can cover the gas fees on behalf of the user. Either way, gas costs are abstracted away from the end user.

What’s next: Paying for gas fees rarely makes sense within a product experience. Gas payments are becoming like cloud infrastructure costs– something the application manages for their users.

Privy makes it easy to provision smart wallets for your users to sponsor their transaction fees. We are also working to support the upcoming EIP7702 transactions, to make it easier for externally owned accounts to act as smart wallets.

Putting it all together

In this post, we’ve covered a few different ways money moves onchain. At Privy, we are constantly amazed at how builders come up with new solutions to very complex technical problems that enable everyone to reap the benefits of interoperability and digital ownership. Though each of these steps must be made into a straightforward product experience, the underlying implementation is loaded with complexity.

Simplifying this stack is a major part of our work: Privy helps you navigate every part of onchain money movement. Today, we offer out of the box flows for onramping and bridging, and easy configuration to provision smart wallets for users to sponsor gas. Our team strives to make it easy for your app to move value onchain.